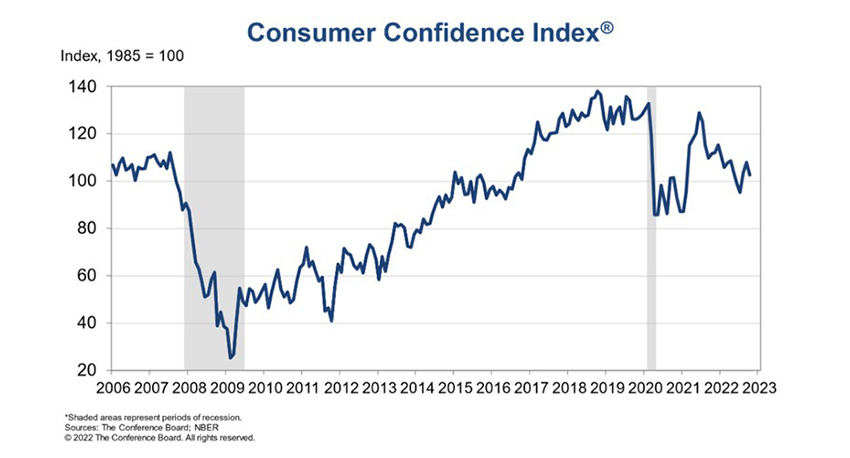

October Consumer Confidence Stumbles

The Conference Board, New York, reported its Consumer Confidence Index fell in October after back-to-back monthly gains. The Index fell to 102.5, down from 107.8 in September.

The Present Situation Index—based on consumers’ assessment of current business and labor market conditions—declined sharply to 138.9 from 150.2 last month. The Expectations Index—based on consumers’ short-term outlook for income, business, and labor market conditions—declined to 78.1 from 79.5.

“The Present Situation Index fell sharply, suggesting economic growth slowed to start Q4,” said Lynn Franco, Senior Director of Economic Indicators with The Conference Board.” Consumers’ expectations regarding the short-term outlook remained dismal. The Expectations Index is still lingering below a reading of 80—a level associated with recession—suggesting recession risks appear to be rising.”

Franco noted concerns about inflation—which had been receding since July—picked up again, with both gas and food prices serving as main drivers. “Looking ahead, inflationary pressures will continue to pose strong headwinds to consumer confidence and spending, which could result in a challenging holiday season for retailers,” she said. “And, given inventories are already in place, if demand falls short, it may result in steep discounting which would reduce retailers’ profit margins.”

“The labor market may still appear tight at present, but today’s consumer confidence report points to a cooling trend with the smallest share of households in 18 months viewing jobs as ‘plentiful,’” said Tim Quinlan, Senior Economist with Wells Fargo Economics, Charlotte, N.C. “The retrenchment in confidence highlights how rising core inflation and growing fears about whether aggressive rate hikes by the Federal Reserve will push the economy into recession is weighing on optimism.

The report said consumers’ assessment of current business conditions was less favorable in October: 17.5% of consumers said business conditions were “good,” down from 20.7%; 24.0% of consumers said business conditions were “bad,” up from 20.9%.

Consumers’ appraisal of the labor market was also less upbeat: 45.2% of consumers said jobs were “plentiful,” down from 49.2%, while 12.7% of consumers said jobs were “hard to get,” up from 11.1%.

Consumers were mixed about the short-term business conditions outlook in October: 19.2% of consumers expect business conditions to improve, up from 18.6%. However, 23.3% expect business conditions to worsen, up from 21.9%.

Consumers were conflicted about the short-term labor market outlook: 19.8% of consumers expect more jobs to be available, up from 17.4%. However, 20.8% anticipate fewer jobs, up from 17.8%.

Consumers were ambivalent about their short-term financial prospects: 18.9% of consumers expect their incomes to increase, up from 18.3%. However, 15.1% expect their incomes will decrease, up from 13.8%.