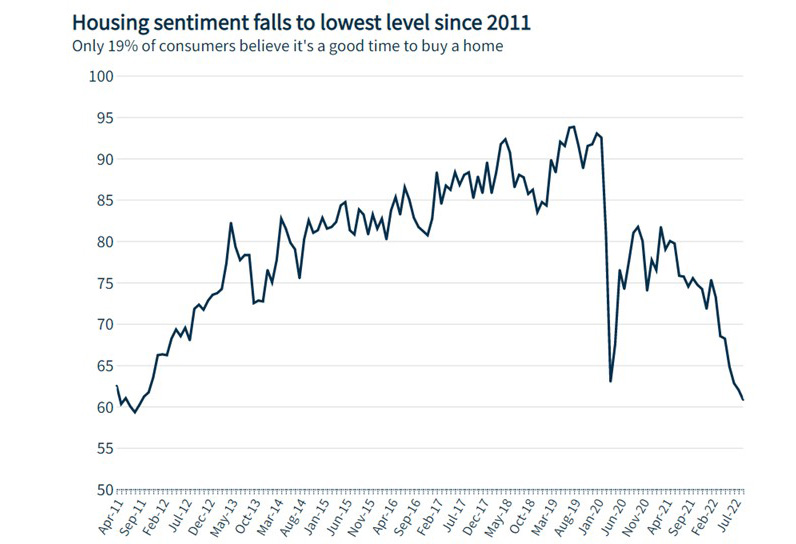

Fannie Mae: Housing Sentiment Closes Near Record Low

Fannie Mae, Washington, D.C., said its Home Purchase Sentiment Index fell by another 1.2 points in September to 60.8, its seventh consecutive monthly decline and its lowest level since 2011, amid growing affordability constraints.

Surveyed consumers reported expectations that mortgage rates will move higher over the next 12 months, and, for the first time since May 2020, more respondents than not expect home prices to decline. In September, only 19% of consumers indicated that it’s a good time to buy a home – down from 22% the prior month – while 59% indicated that it’s a good time to sell. Year over year, the full index is down 13.7 points.

“As long as supply is limited and affordability pressures continue to constrain potential homebuyers via elevated home prices and mortgage rates, we expect home sales will remain sluggish,” said Doug Duncan, Fannie Mae Senior Vice President and Chief Economist.

Other report findings:

–The percentage of respondents who say it is a good time to sell a home remained unchanged at 59%, while the percentage who say it’s a bad time to sell decreased from 35% to 33%.

–The percentage of respondents who say home prices will go up in the next 12 months decreased from 33% to 32%, while the percentage who say home prices will go down increased from 33% to 35%. The share who think home prices will stay the same remained unchanged at 28%.

–The percentage of respondents who say mortgage rates will go down in the next 12 months decreased from 11% to 9%, while the percentage who expect mortgage rates to go up increased from 61% to 64%. The share who think mortgage rates will stay the same decreased from 25% to 20%.

–The percentage of respondents who say they are not concerned about losing their job in the next 12 months decreased from 79% to 78%, while the percentage who say they are concerned remained unchanged at 21%.

–The percentage of respondents who say their household income is significantly higher than it was 12 months ago increased from 25% to 26%, while the percentage who say their household income is significantly lower decreased from 15% to 11%. The percentage who say their household income is about the same increased from 59% to 61%.