Murali Tirupati of Vaultedge: Braving the Inflation Headwind: a Lender’s Guide for Survival

Murali Tirupati is a serial entrepreneur, CEO & co-founder of mortgage automation startup Vaultedge (www.vaultedge.com), which helps mortgage lenders, servicers & investors automate document processing to reduce loan production, boarding & due diligence cost. He has 21 years of enterprise software consulting and sales experience.

Kindled by rising interest rates, the U.S. mortgage market is eventually reaching a vital juncture, leaving lenders to make a string of complicated decisions about the future of their organization.

Recently, the Federal Reserve raised benchmark interest rates by another three-quarter of a percentage point indicating that the rise in the rates will take time to slow down. Industry observers expect more increases as the Fed does what it can to control inflation.

Escalating rates tend to overpower refinancing activity, where lenders compete primarily on the underlying pricing of mortgages. A recent report from ATTOM Data paints a sorry picture of the current state of the refinance market amid rising interest rates which are expected to be raised by the Federal Reserve at least two more times. Several established lenders are already witnessing decreasing volumes in mortgage businesses.

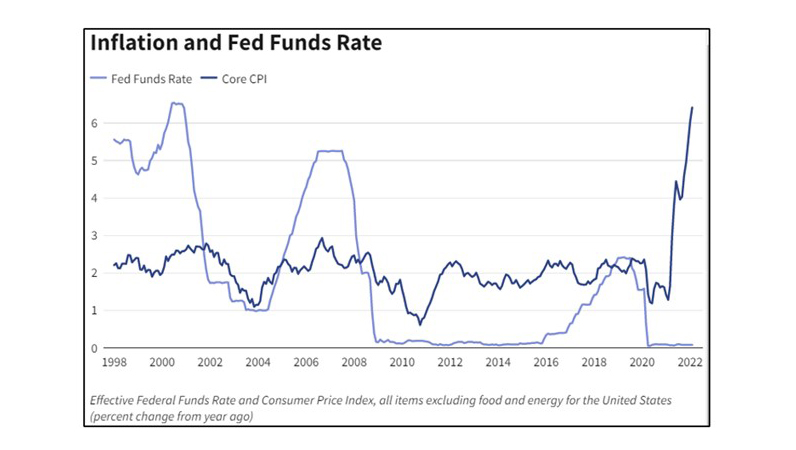

Inflation giving way to rising rates

Inflation and interest rates tend to operate in the same direction because interest rates are the primary tool used by the Federal Reserve to manage inflation. In the U.S, the Federal Reserve targets an average inflation rate of 2% over time by setting a range of its benchmark federal funds rate, the interbank rate on overnight deposits. Usually, higher interest rates are a policy reaction to rising inflation.

When the Federal Reserve responds to soaring inflation by raising its benchmark federal funds rate it effectively raises the level of risk-free reserves in the financial system, limiting the cash supply available for purchases of riskier assets. Similarly, when the Federal Reserve reduces its target interest rate it increases the money supply available to purchase risk assets.

Higher interest rates deter consumer and business spending, especially on commonly financed big-ticket items like housing and capital equipment. Rising interest rates also tend to weigh down asset prices, reversing the wealth effect for people and making banks more cautious in lending decisions.

Lower Mortgage Volume and Margin Compression

One of the primary factors affecting mortgage lenders’ profitability and business operations is margin compression. A recent survey conducted by Fannie Mae reported that most lenders expect to see profits continue to decrease well into 2023, as inflation continues to exceed the two benchmarks.

Since 2015, lender margin of profit expectations has steadily fallen over years. While this issue impacts all banks and mortgage lenders equally, lowering profit margins has put smaller community banks at high risk.

This is often because they do not have additional sources of income, like complex investments or fee incomes which can offset their mortgage profit compression. The bad news is that most industry experts believe that the situation will only get more ominous from here on before it can improve.

There are numerous economic factors involved in pushing the mortgage margins down. With diminishing sales, banks are offering home buyers attractive offers and low-interest rates, which is great for the borrower, but not so good for the mortgage lenders.

This also propels revenue generation down as new loans cease to become as profitable as old ones. Refinancing such homes further compounds the loss, as borrowers attempt to trade longer-term and higher-interest loans for lower-interest ones that stand for a shorter time.

Lenders are facing an incredibly hard and unknown future. It isn’t a pretty picture at all. The motive right now is to survive.

The tide is compelling many lenders to revisit the size and scale of their mortgage operations. While the refi market is both hyper-competitive and rate-dependent, the purchase market can often depend on nurturing customer relationships. Mortgage lenders need organizations that can help them guide them through these challenges and help them with various ways to improve their bottom line, from low-cost operational solutions to forward-looking technology that improves business and productivity. U.S. mortgage lenders need to transform their operations to address these issues while shifting from fixed to high-quality variable costs.

In the following section, we will talk about a few aspects that mortgage lenders need to consider while deciding on which option to choose to survive the storm.

The lender’s survival kit

At the highest level, lenders can take a call on three strategic steps:

- Staying Put: Decide to first break even and then retreat to profitability

- Find a buyer: Connect with a buyer who is willing to purchase the company for a fair price

- Close shop: Cease to exist. Preserve the hard-earned capital and decide to reinvest elsewhere

The decision-making process can be complex and time-consuming, but it doesn’t have to be. With the right tools and resources, one can streamline the business’s strategic planning process and get more out of every meeting. Doing well in a difficult market is always a challenge, but of the three possibilities available to mortgage lenders, staying in the field is the one most will choose.

But before proceeding with a strategic option, a thorough assessment of the existing state of the primary shareholders and the organization is vital.

As archaic as it sounds, the age of the primary stakeholder needs to be considered. An entrepreneur in the mortgage industry, who is in his/her mid-50s can be assumed to have achieved a certain amount of success and may consider this a good time to sell the company, especially after say a few years of profit. It will also rely upon the financial standing of the owners. The ones that have not diversified financially may choose to exit the business as they are closer to retirement so they can use the sales proceeds and invest in different kinds of investments that correspond to future cash flow needs and risk tolerance. On the other hand, those with other investments may find it easier to sustain, as they don’t have all their investments tied to the company alone.

The existing condition of the business is important too when a lender has to take any of the aforementioned steps. For instance, an owner who might have seen glorious days by offering streamlined refinance loans over the past couple of years may find the cost of restructuring for the current market to be a major obstacle and choose to exit.

Once the decision has been made, then comes the elbow grease.

Staying Put

Braving this challenge will need the management to aim for two short-term objectives. Identify the pain points and prevent further damage and emphasize maximizing the current revenue. This surely sounds as scary as a James Wan horror flick. However, with the right tools, guidance, and strategy, fighting the fight won’t be difficult.

Transitioning from a fixed-cost model to a variable one

When companies solve problems like low productivity, higher volume than can be handled, and long cycle times by hiring more people, at first it looks like a viable solution. In reality, it’s nothing but a band-aid for a wound that needs stitches.

Some lenders feel that the way to grow in a down market is to take market share from competitors. However, in the current market taking market share from competitors means doing more purchase loans. Purchase loans need more work per loan. But lenders cannot afford to hire people in this market. Margins are just too tight.

While adding more people may fix the problem temporarily, it is not a permanent solution. Also, compensation is the most expensive aspect to keep a business afloat, and adding more staff will only gnaw away the profit. Of course, when business slows down, the company will be forced to lay off the very people they hired to get them out of the jam in the first place.

A variable cost model can be used to combat the difficulties of relying solely on human expertise, and the underlying fixed costs accompanying it. A variable model is an outsourcing engagement where the company pays for the loans processed instead of maintaining salaries. They only pay for the loans that they have and not necessarily for the staff that they have.

Cutting down on costs

When lenders look at the costs associated with origination, the most significant of these is always personnel. This point almost echoes the same thought as the previous one. Lenders who want to succeed through this decline will have to onboard employees optimally. For most, that means letting people go— assuming that every job can be saved in the current market is not realistic.

A lender can gauge how much the business is expected to originate and then take a call on assembling a functional and optimized staff. Only then can a lender create a plausible production forecast and modify associated staffing and costs consequently.

Simultaneously as the lender is rightsizing personnel, management will also be lowering overhead costs to go with the changes in production. Creating target metrics that are reasonable and supported by industry benchmark data is a crucial first step.

The organizational restructuring may be the result of staffing adjustments, and lenders should identify opportunities to cross-train existing employees and put performance evaluation parameters in place. Aligning individual goals, and monitoring performance progress can help identify individuals who need additional training to improve — or who may not be suited for a different position in the mortgage industry.

There are several tools available to help lenders with this activity including reviewing existing contracts, shifting fixed costs to variable costs, and establishing the company’s new breakeven point.

Using the right technology

Technology continues to evolve rapidly in the lending space, and terms such as AI, RPA, and ML are becoming more commonplace in tech stack discussions.

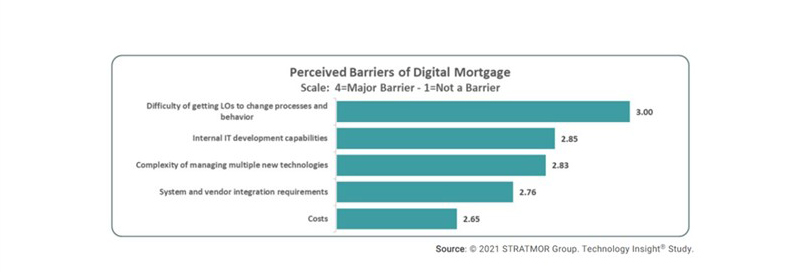

Automation, a term that is deeply intertwined with the philosophy of making processes faster, is a business-driven, disciplined approach that companies use to rapidly identify, vet, and automate as many processes as possible. Yet, most often companies encounter a barrage of challenges when it comes to adopting technology. Hurdles like getting Loan Officers to start using new software, in-house IT challenges, complex management of new technologies, and such.

Efforts should be made to expand adoption, and importance should be given to retiring ineffective technology and/or exploring other tech options.

Possibly the most crucial step is developing a strategy, roadmap, and timeline to implement the needed changes. Most often lenders lack the bandwidth to carry out this technological shuffling in-house and seek help outside.

Improve the Customer Experience

While developing the roadmap, strategy and timeline remains vitally important, it is also important that lenders continue to excel when it comes to customer service in this process. Often, this includes a disruptive technology ecosystem with proprietary RPA, AI, digital workflow, and predictive analysis.

Increasing the lender’s Net Promoter Score (NPS) in customer satisfaction can have a significant impact on repeat and referral business, and the tools needed to collect, analyze and implement customer feedback may be budget-friendly.

Costs, uncertainty, an uber-competitive mortgage market, and the potential for a drawn-out buying process are a few factors that can create bottlenecks in the purchasing journey for the consumer. Making the customer at the crux of the experience, with products and services that are easy on the pocket and time-saving, is a way for lenders to add noteworthy value to the process.

The market is brimming with competition, doing so can also help lenders differentiate themselves from the rest and deliver exemplary value to the consumer.

Find a Buyer

Many industry leaders will choose to throw themselves into combat and continue to fight. For some, it will make more sense to sell the company and move to other pursuits. According to a report by the STRATMOR Group, there were more than 50 Merger & Acquisition deals over the two years, but it’s been projected that there could be more than 50 M&A deals in 2022 alone.

Lenders who are thinking about selling their business need to start the process early to understand how to maximize value. There may be certain things that a lender needs to stage the house, and that need some level of planning and a certain degree of confidentiality. It’s not that the news of M&A will be kept under wraps in perpetuity, but there need to be a few restraints that have to be maintained during the process.

Mortgage lenders need to evaluate the transaction’s impact from the perspective of sales, operations, and corporate staff. A thorough analysis needs to be done about pricing, products, offerings, tech stacks, personnel-whether they continue to be the same or get impacted by the purchase. Employees need to be informed about the changes and the opportunities that come along with them.

In all honesty, an M&A conversation is mainly about numbers. If the numbers tally, there is a deal, and if not, then the lender can move to the next potential buyer. But owners also need to evaluate possible matches for culture and synergy.

Close Shop

Closing down should not be taken as a failure. Experienced business leaders are cognizant of the fact that sometimes it makes the most sense to end a business to conserve capital, avoid the unintended effects of clinging on for too long, and utilize their time, experience, and resources elsewhere.

Objectively if the business’ operating model is no longer viable and the cost to optimize is expensive or the results doubtful, shutting down the business should be assessed. If the company is facing a loss each month and a turnaround is not likely nearby, business owners may choose a wind-down instead to preserve their hard-earned equity.

Taking the call to shut down is tough. It is an emotional decision as much as it is a financial decision. That is why many owners tend to wait and watch. But that can cause great upheaval for everyone involved. Delaying the decision ‘just a little longer,’ could, unfortunately, burn the assets that could go toward softening the landing for those impacted.

Working with a trusted advisor can help make this difficult decision easier. The market is very different from what it was a year ago, and employing a third-party objective advisor can speed things up. It’s essential to develop a go-forward plan and then execute it with precision and exacting detail. This helps people remain focused, reduces confusion, and helps to keep the lights on till it’s time to pull the plug.

When it comes to making this tough call, confidentiality is primary. It is also important, to be honest, and transparent while communicating the company’s objectives and plan. Lenders need to collaborate with their Human Resources, Legal, and Communications teams so that the right message is imparted and not a distorted version that can cause a serious dent in the company’s reputation.

In conclusion

As the mortgage market continues to shrink, lenders are faced with major decisions about how to remain profitable. Lenders may decide to fight on or sell their business, but they cannot stand still; they need new strategies to help them improve their bottom line—and part of those strategies could include reimagining the role of technology in their business.

Many lenders expect profits to continue to decrease into 2023 as personnel expenses increase among those lower volumes. Lenders need to be prepared for the new lending landscape and use innovative solutions as the catalyst for future success.

Regardless of which path the lending enterprise decides to tread on, now is the time to make that decision. If you want to survive, you have to decide.

(Views expressed in this article do not necessarily reflect policy of the Mortgage Bankers Association, nor do they connote an MBA endorsement of a specific company, product or service. MBA NewsLink welcomes your submissions. Inquiries can be sent to Mike Sorohan, editor, at msorohan@mba.org; or Michael Tucker, editorial manager, at mtucker@mba.org.)