STR: Hotel Construction Pipeline Increases for 3rd Month

U.S. hotel construction ticked upward in September for the third consecutive month, reported STR, Hendersonville, Tenn.

Year-over-year declines have decreased each month since May 2022, STR said in its quarterly hotel pipeline report.

“There are plenty of concerns around the industry given the likelihood of a recession, but for most markets, new supply will not be an additional headwind in the short term,” said Alison Hoyt, STR Senior Director of Consulting.

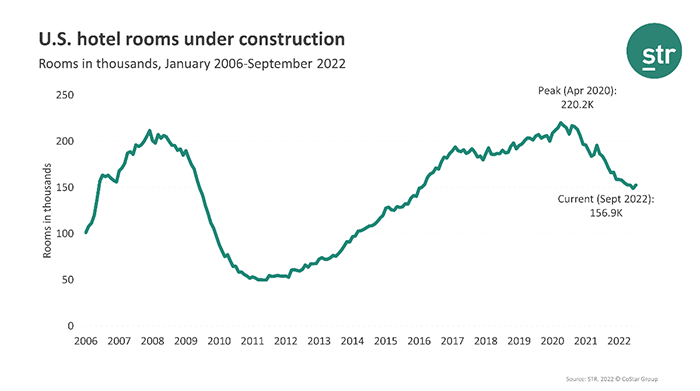

Hoyt noted hotel construction activity is down compared to a year ago and said the industry is 63,000 rooms below its 2020 construction peak. “That places the possibility of new supply increasing competition further out on the horizon,” she said.

At the market level, New York, Phoenix and Nashville will see the largest supply percentage increases from current construction, the report said. Among the chain scales, the Luxury and Upscale segments lead in that measurement.

The U.S. hotel pipeline includes 156,861 rooms in construction, down 8.9% from one year ago. There are 282,225 rooms in the planning stage, up 7% from September 2021.

Looking at just the in-construction phase, STR said luxury chain scales show the highest number of rooms as a percentage of existing supply, followed by upscale and upper-midscale properties.

“Limited-service continues to lead the national pipeline based on room count, but when you look at the numbers by percentage of existing rooms, it’s luxury hotels at the forefront,” Hoyt said. “That trend, however, does not correlate across the board when looking at individual markets. New York City, for example, shows in-construction economy hotels holding the highest percentage of existing supply. The market has been quite a comeback story over the last few months, achieving high levels in revenue per available room compared with other markets, thus remaining an attractive option to developers.”