Zillow: First-time Home Buyers Return Despite Affordability Challenges

Zillow, Seattle, reported first-time home buyers have returned to the housing market–and those who can afford a home are finding success after years of setbacks.

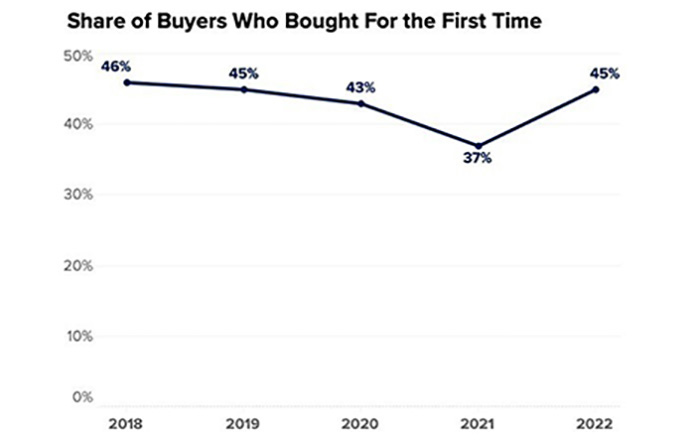

The share of buyers purchasing a home for the first time has rebounded to pre-pandemic levels, Zillow said in its 2022 Consumer Housing Trends Report. First-timers now represent 45% of all buyers, up from 37% of buyers surveyed last year.

“If they can overcome affordability challenges, first-time buyers could be well-positioned to continue increasing their share in today’s shifting market, with more options and time to decide on the right home,” the report said.

The share of first-time buyers plummeted during the pandemic amid rapidly rising home values and tough competition. Zillow found younger, likely first-time shoppers often lost out to older, repeat buyers who could tap the equity in their existing homes to make a stronger offer. Another Zillow survey found younger buyers were more likely to report losing to an all-cash buyer at least once, as was the case for 45% of Gen Z and 38% of millennial buyers, compared to 30% of all buyers.

“First-time buyers now appear to be making relative gains as high mortgage interest rates disproportionately encourage current homeowners to stay put,” said Manny Garcia, Population Scientist with Zillow. “The flow of homes into the market is slowing, suggesting homeowners are likely comparing their current low mortgage rate to today’s rates and deciding not to move.”

Garcia noted rising mortgage rates hurt affordability for all buyers, but said first-time buyers may be less deterred by higher rates “because they’re comparing a monthly mortgage payment to what they’re paying in rent.”

First-time buyers now make up a larger share of a smaller pie, the report said. Newly pending home sales were down 29% in August compared to a year prior as buyers struggled to keep up with higher home prices and interest rates. Home values remain 14.1% higher than last year, even after two consecutive month-over-month declines. When combined with rising mortgage interest rates, the typical monthly payment on a home is nearly 60% higher today than it was a year ago.

“The silver lining is that today’s much-needed market rebalancing has the potential to especially benefit first-time buyers, who have the flexibility to shop without trying to time the purchase of their new home with the sale of an existing home,” Zillow said. “Listings typically lingered 16 days on the market in August before going under contract, compared to eight days in June, meaning buyers have twice as much time to decide on a home compared to this time last year.”

First-time buyers may also have more bargaining power as more sellers drop their prices: the share of listings with a price cut grew to 28% in August, the report said.