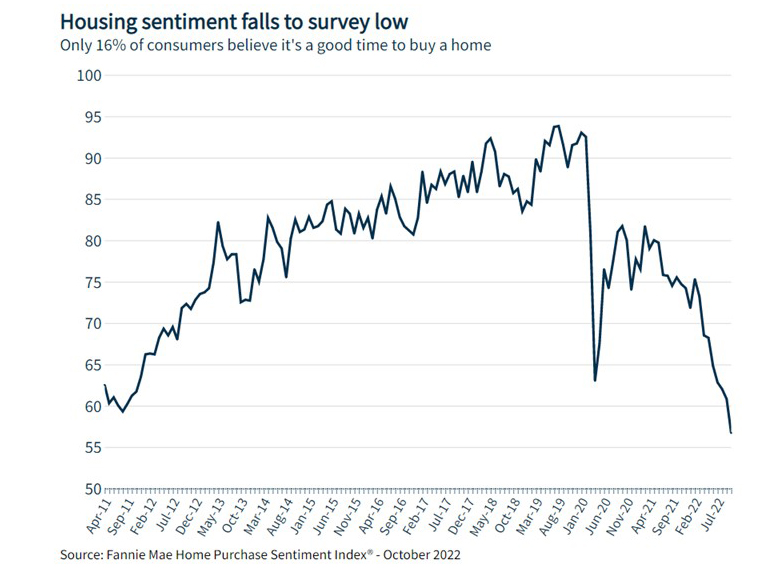

Fannie Mae Consumer Survey Falls to Record Low

Fannie Mae, Washington, D.C., said its monthly Home Purchase Sentiment Index fell by 4.1 points in October to 56.7, its eighth consecutive monthly decline and lowest reading since inception of the index in 2011.

Five of the six index components decreased month over month, including those associated with home buying and selling conditions, as persistently high home prices and unfavorable mortgage rates continue to fuel consumers’ housing affordability concerns. Only 16% of respondents indicated that now is a good time to buy a home – a new survey low – while the percentage who believe now is a good time to sell a home decreased sharply from 59% to 51% in October. Year over year, the full index is down 18.8 points.

“The HPSI reached an all-time survey low this month, in line with expectations that the housing market will continue to cool in the months ahead,” said Doug Duncan, Fannie Mae Senior Vice President and Chief Economist. “Consumers are increasingly pessimistic about both homebuying and home-selling conditions. Amid persistently high home prices and unfavorable mortgage rates, the ‘bad time to buy’ component increased to a new survey high this month, while the ‘good time to sell’ component continued its downward trend.

Other report findings:

- Good/Bad Time to Buy: The percentage of respondents who say it is a good time to buy a home decreased from 19% to 16%, while the percentage who say it is a bad time to buy increased from 75% to 80%.

- Good/Bad Time to Sell: The percentage of respondents who say it is a good time to sell a home decreased from 59% to 51%, while the percentage who say it’s a bad time to sell increased from 33% to 42%.

- Home Price Expectations: The percentage of respondents who say home prices will go up in the next 12 months decreased from 32% to 30%, while the percentage who say home prices will go down increased from 35% to 37%. The share who think home prices will stay the same decreased from 28% to 26%.

- Mortgage Rate Expectations: The percentage of respondents who say mortgage rates will go down in the next 12 months decreased from 9% to 6%, while the percentage who expect mortgage rates to go up increased from 64% to 65%. The share who think mortgage rates will stay the same increased from 20% to 24%.

- Job Loss Concern: The percentage of respondents who say they are not concerned about losing their job in the next 12 months increased from 78% to 85%, while the percentage who say they are concerned decreased from 21% to 15%.

- Household Income: The percentage of respondents who say their household income is significantly higher than it was 12 months ago decreased from 26% to 25%, while the percentage who say their household income is significantly lower increased from 11% to 15%. The percentage who say their household income is about the same decreased from 61% to 60%.