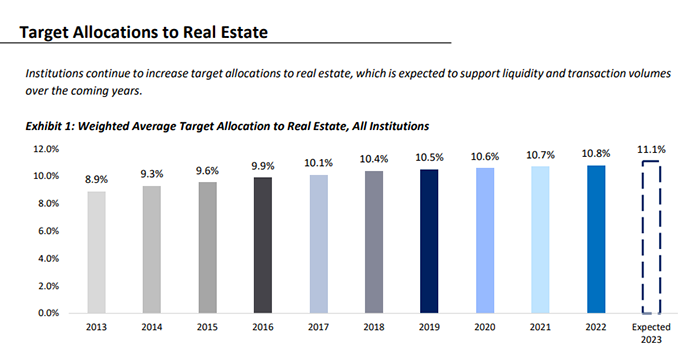

Investors Increase Real Estate Target Allocations

Institutional investors continue to increase their target allocations to real estate and expect attractive buying opportunities to emerge over the next several years, reported Hodes Weill & Associates and Cornell University in their annual Institutional Real Estate Allocations Monitor.

The report noted economic turmoil, geopolitical risk and rising inflation and interest rates contributed to the first decline in institutional investor confidence in real estate in five years. This decreased conviction coupled with portfolio overallocation has slowed deployment pacing in recent months. But looking ahead, institutions plan to increase their allocations to real estate by 30 basis points in 2023 to 11.1% .

“While institutions have slowed their pace of deployment in the face of overallocation, it is likely they’ll be highly active in the next two years as compelling investment opportunities emerge following this period of uncertainty,” said Douglas Weill, Managing Partner at Hodes Weill & Associates. “If market volatility leads to distress and dislocation, the next several years may prove to be good vintage years for capital deployment.”

Weill noted some signs that institutional capital is returning to the market to take advantage of distress. “Several pensions and sovereign wealth funds are actively investing in public real estate investment trusts and debt securities and deploying capital into credit strategies,” he said.

The report said real estate continues to outperform target expectations in institutional portfolios. Institutions have seen a 9.9% average annual return over the last five years, significantly ahead of the 8.2% average target return benchmark. Following pandemic-related underperformance in 2020, institutional real estate portfolios bounced back in 2021, generating an outsized 17.1% average annual return. “This outperformance, combined with the denominator effect, has contributed to a tripling in the number of institutions reporting overallocation to real estate,” the report said.

Institutional investors’ target allocations to real estate increased for the ninth straight year in 2022 to 10.8%–up 10 basis points from 2021 and consistent with the annual rate of growth over the last four years. This increase in target allocations implies there could be up to $120 billion of capital allocations to real estate in the coming years. Institutions forecast a further 30 basis point increase in 2023, which would be the largest year-over-year increase since 2014.

Hodes Weill and Cornell anticipate growth in allocations will be fairly consistent across regions, with institutions in the Americas expecting to increase allocations by 40 basis points and institutions in the Europe-Middle East-Africa and Asia-Pacific regions expecting to increase allocations by 30 basis points and 20 basis points, respectively.