Highlights of MBA’s Revised May Forecasts

The Mortgage Bankers Association released its revised monthly Economic Forecast and monthly Mortgage Finance Forecast. Here are highlights and commentary from MBA Associate Vice President of Economic and Industry Forecasting Joel Kan:

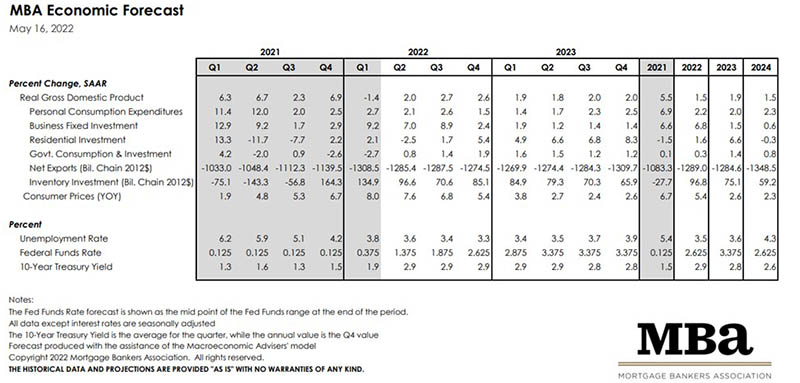

—GDP growth is expected to average 1.5% in 2022, 1.9% in 2023 and 1.8% in 2024. These are downward revisions from the April forecast. Growth expectations are being impacted by higher rates, higher prices and weakening consumer sentiment.

—Inflation is expected to peak in the first half of 2022 close to 8% and end the year at 5.4% (Q4 to Q4), higher than previously forecasted. Prices of key consumer items such as food, vehicles, and motor fuel remain elevated. Food prices accelerated further in April. We forecast inflation cool slightly in 2023 (2.6%) and 2024 (2.3%) as monetary policy tightens and consumer demand falls, but there are still some upside risks to prices from disruptions in Ukraine and China. Shelter inflation accelerated slightly in April and the impact of rising shelter costs will continue to exert upward pressure on headline inflation.

—The U.S. economy is still adding more than 500,000 job gains per month thus far in 2022 and the unemployment rate remains low at 3.6%. We expect the unemployment rate to continue to decline to a low of 3.3% in late 2022 before rising in 2023 and 2024 to 3.6% and 4.3%, respectively, as overall economic growth slows.

–Given that we are past full employment and with inflation running over 8% annually, the Federal Reserve is expected to continue with rapid rate hikes this year, and for the fed funds rate to reach a range of 2.5%-2.75% by the end of 2022. This amounts to 50 bps rate hikes at each of the next two meetings and 25 bps hikes at each meeting after that. We expect the rate hikes to continue through mid-2023, with the fed funds rate reaching 3.25%-3.5% in the middle of 2023.

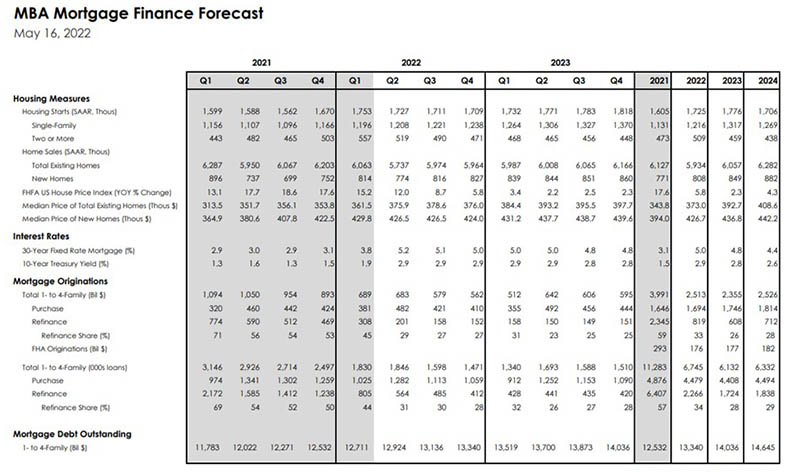

—Balance sheet reduction has commenced and will be ramped up to reductions of $95 billion per month. Mortgage rates will likely remain elevated and volatile in the near term as a result. Our forecast is for the 10-year Treasury yield to remain in the 2.9% range through mid-2023 and for mortgage rates to remain over 5% for most of 2022. As spreads settle, mortgage rates are forecast to be in the range of 4.8% to 5% in 2023.

—Recent home sales and mortgage applications data showed lower than expected purchase activity for this time of the year because of these higher rates combined with the existing inventory shortages and higher building costs. As a result, we lowered our forecast for new and existing home sales for the forecast period, with existing home sales showing a decline in 2022 and new home sales seeing a smaller increase in 2022. A healthy job market, and demographic drivers such as a large cohort of younger home buyers, are still supportive of housing demand, but growth has been limited by the inventory and affordability challenges.

–We lowered our forecast for overall originations in 2022 to $2.5T from $2.6T. Purchase originations were revised to $1.69T from $1.72 trillion for 2022 given the purchase conditions outlined above. Refinance originations are forecast to total $819 billion, a downward revision from $841 billion from last month’s forecast, as higher rates continue to push borrowers further out of the money.

—Total originations are expected to be $2.3T in 2023, as purchase grows to $1.75T but refi falls to $608 billion. 2024 is expected to see $2.5T, with another increase in purchase to $1.81T and refi at $712 billion.