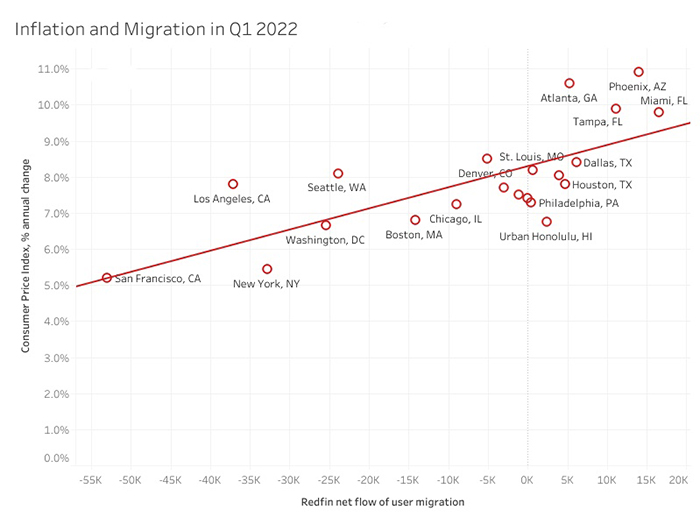

Sun Belt Housing Hotspots See the Highest Inflation

Some hot migration destinations for homebuyers including Phoenix, Tampa and Atlanta have the highest inflation rates in the U.S., reported Redfin, Seattle.

“Not everyone in the country is experiencing inflation the same way,” said Redfin Deputy Chief Economist Taylor Marr. “It’s having an especially big impact in places like Tampa and Phoenix, which are attracting the most new residents and seeing double-digit increases in prices overall and even bigger increases in housing costs.”

Marr said these Sun Belt hot spots need new housing construction to ease some of the competition for local homebuyers. “That’s especially important as everyday costs like paying rent and buying food become more burdensome,” he said, noting wages are up about 7% in Atlanta from a year ago but inflation is up 10% and asking rents are up 22%. “That means it’s becoming more difficult to save for a down payment and break into homeownership even before you factor in sky-high home prices and rising mortgage rates.”

In Phoenix, prices of goods and services rose 10.9% year-over-year in the first quarter, the highest inflation rate of the metros RedFin examined. Phoenix was also the second-most popular destination for homebuyers looking to move from one metro to another in the first quarter, behind only Miami.

Atlanta, the tenth-most popular migration destination, had the second-highest inflation rate at 10.6%. And Tampa, with a 9.9% increase in prices, clocked in at number three for both inflation and migration.

San Francisco, New York and Washington, D.C. follow the opposite trend, the RedFin report said. San Francisco, which topped the list of metros homebuyers moved away from in the first quarter, currently has a 5.2% inflation rate, the lowest in the country and roughly half that of Phoenix, Tampa and Atlanta. New York, with the second-lowest inflation rate (5.4%), is the number-three place homebuyers left.

Nationwide, prices were up 8.5% year-over-year in March, the highest rate in 40 years. Policymakers consider 2% an acceptable level of inflation.

“The good news is that because most families own their home, they’re building wealth from rising home values, even if they are paying more for everything else,” Marr said. “There’s also a bright spot for prospective buyers: I expect competition to slow down in the coming months as mortgage rates rise and some buyers back out of the market, and wage gains are likely to continue increasing.”

Home prices are skyrocketing in America’s most popular destinations partly because so many people are moving in–a record share of homebuyers relocated in the first quarter. Rapidly rising home prices are one contributor to inflation, the report noted.

But the trend may slow in the future as the financial benefit of living in a place such as Phoenix diminishes. Homes are becoming less affordable more quickly in Sun Belt metros than in coastal areas. Homebuyers in Phoenix, for instance, need to earn 46% more than they did a year ago to afford the area’s typical monthly mortgage payment, compared with 26% more in San Francisco, RedFin said.