CoreLogic Reports U.S. Annual Home Price Growth Exceeds 20% in March

CoreLogic, Irvine, Calif., said U.S. home prices continued to post significant year-over-year gains in March, up by 20.9%, another record high.

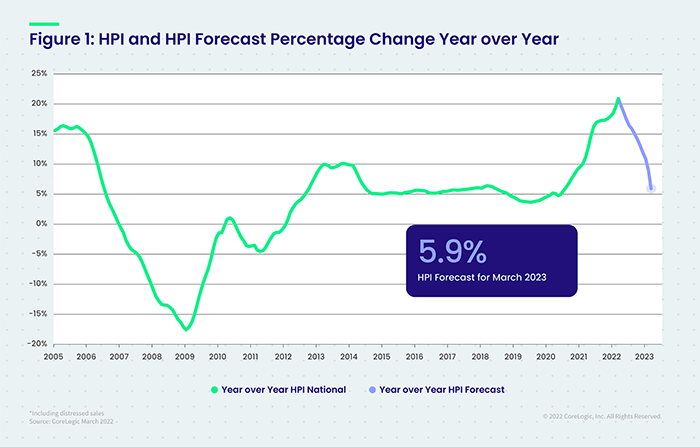

But CoreLogic forecasts annual gains will slow to around 6% by next March, due in part to rising mortgage rates and higher home prices hampering affordability for some home shoppers. Buyers who closed on a property in March had a good chance of locking in mortgage rates around 4% or slightly lower. By late April, rates had moved up to more than 5%, a jump of about 30% from the same time last year and a trend that might derail more prospective buyers.

“The annual growth in the U.S. index was the largest we have measured in the 45-year history of the CoreLogic Home Price Index,” said Frank Nothaft, Chief Economist with CoreLogic. “Couple that price increase with the rapid rise in mortgage rates and buyer affordability has fallen sharply.”

Nothaft noted that in April 30-year fixed mortgage rates averaged nearly 2 percentage points higher than one year earlier. “With the growth in home prices, that means the monthly principal and interest payment to buy the median-priced home was up about 50% in April compared with last April.”

The CoreLogic Home Price Index report also found the annual appreciation of detached properties (22%) was 4.7 percentage points higher than that of attached properties (17.3%) in March.

In March, Tampa, Fla., logged the highest year-over-year home price increase of the 20 largest metros at 32.5%. Phoenix ranked second with a 30.4% year-over-year gain. On the lower end of the price growth spectrum were the New York and Washington, D.C. metros, both at 9.9%.

The CoreLogic HPI Forecast report said annual home price gains will likely slow to 5.9% by March 2023.