Multifamily Nearly—But Not Quite—Saves April Housing Starts

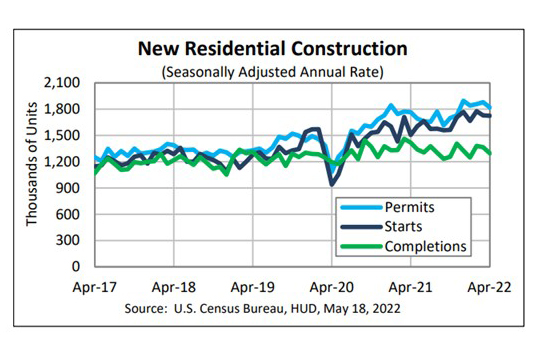

April housing starts fell by just 0.2 percent from March—no thanks to single-family starts, which fell by more than 7 percent—HUD and the Census Bureau reported Wednesday.

The report said privately owned housing starts in April fell to a seasonally adjusted annual rate of 1,724,000, 0.2 percent below the revised March estimate of 1,728,000, but 14.6 percent higher than a year ago (1,505,000). Single‐family housing starts in April fell to 1,100,000, 7.3 percent lower than the revised March figure of 1,187,000. The April rate for units in buildings with five units or more improved to 612,000, up by nearly 17 percent from March (524,000) and up by 42.3 percent from a year ago.

Regionally, results were mixed. In the largest region, the South, starts rose by 10.6 percent in April to 926,000 units, seasonally annually adjusted, from 837,000 units in March and improved by 18.4 percent from a year ago. In the West, starts rose by 3.3 percent to 432,000 units in April from 418,000 units in March and improved by 11.6 percent from a year ago.

In the Midwest, however, starts fell by 22 percent in April to 184,000 units, seasonally annually adjusted, from 236,000 units in March but improved by 2.2 percent from a year ago. in the Northeast, starts fell by 23.2 percent to 182,000 units in April from 237,000 units in March but improved by nearly 17 percent from a year ago.

“Builders still have a backlog of uncompleted homes to get through before they can break ground on new projects,” said Odeta Kushi, Deputy Chief Economist with First American Financial Corp., Santa Ana, Calif. “On a more positive note, this was a strong month for multi-family construction.”

Kushi said builders continue to face supply chain disruptions, rising input costs and concerns that declining affordability is pricing out potential buyers, particularly first-time home buyers, which are the most rate sensitive. “Housing demand is softening, but that means more balance is coming to the housing market,” she said. “The housing market of 2020 and 2021 was the exception, not the norm.”

Looking ahead, Kushi said. lack of existing home inventory could worsen as rates rise. “Existing owners are ‘rate locked-in’ when their existing rate is below the prevailing market rate,” she said. “This places even more importance on homebuilding. You can’t buy what’s not for sale, but you can build it.”

“Following strong activity to start the year, housing starts have stumbled as of late as surging mortgage rates have extinguished some demand in the market,” said Sam Bullard, Senior Economist with Wells Fargo Economics, Charlotte, N.C. “Last month’s weakness was entirely attributable to the single-family market.”4

Bullard said even with growing backlogs, builders are having little trouble finding buyers as an increasing number of homes that have not started construction are going on the market. “[And] builders continue to struggle in securing a wide variety of critical building materials needed to complete homes. Even when they do have success in sourcing materials, the costs they are paying are sky-high. According to the April PPI report, wholesale construction materials are up nearly 18% over the past year.”

Doug Duncan, Chief Economist with Fannie Mae, Washington, D.C., sounded a more optimistic note. “We expect new home construction to remain relatively strong compared to existing sales in the near term due to an ongoing backlog of orders from new homes sold but not yet started, attributable to the ongoing material and labor shortages that have caused builders to postpone projects and decline new orders,” he said. “Mortgage rates, now at their highest level in more than a decade, will likely take a larger toll on starts later in the year, which may be partially reflected in not only the 3.2 percent decline in permits but also the National Association of Home Builders’ survey results showing significantly lower demand in May.”

Building Permits

Privately owned housing units authorized by building permits in April fell to a seasonally adjusted annual rate of 1,819,000, 3.2 percent below the revised March rate of 1,879,000, but 3.1 percent higher than a year ago (1,765,000). Single‐family authorizations in April fell to 1,110,000, 4.6 percent below the revised March figure of 1,163,000. Authorizations of units in buildings with five units or more fell to 656,000 in April, down by 0.6 percent from March (660,000) but up by 16.3 percent from a year ago.

Housing Completions

Privately owned housing completions in April fell to a seasonally adjusted annual rate of 1,295,000, 5.1 percent below the revised March estimate of 1,365,000 and 8.6 percent lower than a year ago (1,417,000). Single‐family housing completions in April fell to 1,001,000, 4.9 percent below the revised March rate of 1,053,000. The April rate for units in buildings with five units or more fell to 281,000, down by 6.6 percent from March (301,000) and down by 33.3 percent from a year ago.