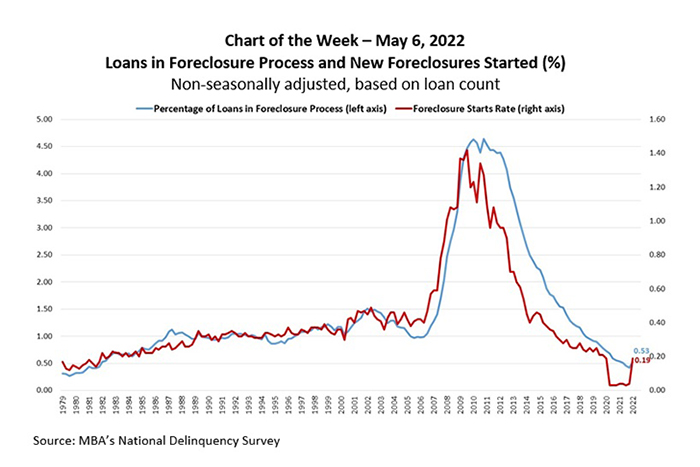

MBA Chart of the Week May 9, 2022: Loans in Foreclosure Process

The Mortgage Bankers Association’s National Delinquency Survey was released last week, covering national and state delinquencies through the first quarter of 2022.

The delinquency rate for mortgage loans on one‐to‐four‐unit residential properties fell to a seasonally adjusted rate of 4.11 percent of all loans outstanding at the end of the first quarter of this year. Most of the improvement in loan performance can be attributed to the movement of loans that were 90-days or more delinquent. The majority of these aged delinquencies were either cured or entered post-forbearance loan workouts.

The expiration of pandemic-related foreclosure moratoriums led to a modest increase in foreclosure starts from the record lows maintained over the past two years, as displayed in this week’s MBA Chart of the Week. At 0.19 percent, the foreclosure starts rate remains below the quarterly average of 0.41 percent dating back to 1979. While the percentage of loans in the foreclosure process also rose in the first quarter, at 0.53 percent, the foreclosure inventory rate is still well below the historical quarterly average of 1.43 percent.

Given the nation’s limited housing inventory and the variety of home retention and foreclosure alternatives on the table across various loan types, the probability of a significant foreclosure surge is minimal. Borrowers have more choices today to either stay in their homes or sell without resorting to a foreclosure.

– Anh Doan (adoan@mba.org); Marina Walsh (mwalsh@mba.org)