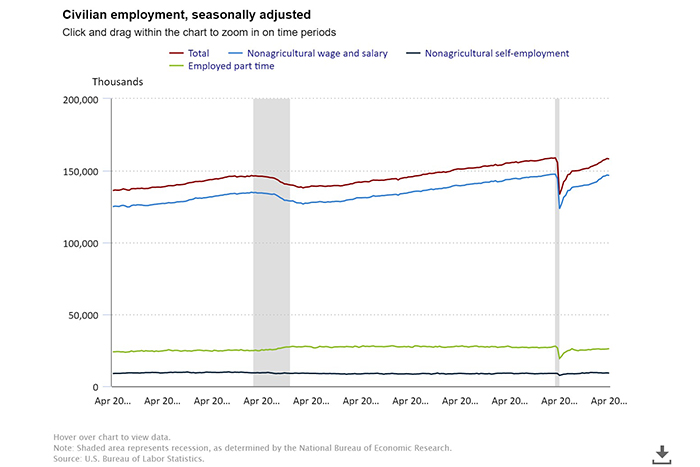

Employment Approaches Pre-Pandemic Levels

U.S. employment rolls increased by more than 425,000 in April, the Bureau of Labor Statistics reported Friday.

“Job growth was widespread, led by gains in leisure and hospitality, in manufacturing and in transportation and warehousing,” BLS said in its monthly Employment Situation Summary.

MBA Senior Vice President and Chief Economist Mike Fratantoni noted another strong month of job growth has brought U.S. employment to within 0.8% of its pre-pandemic level. He said job growth has averaged 523,000 over the past three months, “which is much faster than can be sustained over time.”

First American Deputy Chief Economist Odeta Kushi said the jobs report exceeded expectations, demonstrating the economy’s strength amid rising rates.

Fratantoni said employment in mortgage lending may be declining due to the sharp drop in refinance volume but noted overall employment in the financial sector is growing, “which may well provide opportunities to shift employees from mortgage to other sectors within finance.”

The labor force participation rate changed little, BLS reported. Fratantoni said the unemployment rate is likely to drop further with 11.5 million job openings at this pace of job growth. MBA forecasts the unemployment rate will reach 3.3% as a low point later this year.

Average hourly earnings were up 5.5% over the past year, a bit less than in March, and well below the pace of inflation. “Even with this tight job market, wage gains are not keeping up with the prices consumers are paying,” Fratantoni said.

The number of people teleworking due to the pandemic fell to 7.7% in April compared to 10% in March. “Clearly, big employers are beginning to bring employees back to the office,” Fratantoni said. “This is another piece of good news for the office market, even beyond the strong signal from continued rapid job growth.” Fratantoni said housing demand continues to benefit from one of the strongest job markets we have experienced in the last 50 years. “Although mortgage rates have risen sharply and home prices have continued to rise at a rapid pace, we expect that many potential homebuyers will continue to be in the market given their strong financial position.”