Fannie Mae: Growing Number of Consumers Expect Rates, Home Prices to Rise Further

The Fannie Mae Home Purchase Sentiment Index increased by 3.5 points to 75.3 in February, but showed affordability constraints continue to drive consumers’ perception of the housing market.

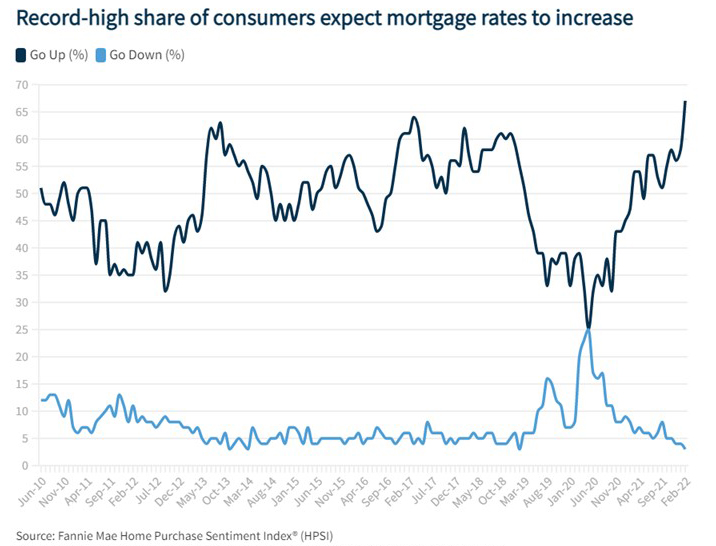

Overall, five of the index’s six components increased month over month, including the components measuring consumers’ perceptions of homebuying and home-selling conditions. However, on net, the ‘Good Time to Buy” component remains near its recently established record low, as survey respondents continue to cite high home prices as the primary impediment to purchasing. Consumers did report a substantially improved sense of job security, but a much greater share indicated that they expect mortgage rates to move even higher. Year over year, the full index is down 1.2 points.

“A survey-record share of consumers – particularly homeowners and higher-income individuals – expect mortgage rates to increase in the next 12 months, likely owing to signals that the Fed will raise rates to slow the pace of inflation,” said Doug Duncan, Fannie Mae Senior Vice President and Chief Economist. “High home prices continue to be the most commonly cited reason by consumers for their belief that it’s a good time to sell (and a bad time to buy) a home; notably, the ‘good time to buy’ sentiment among renters dropped to a new survey low. This suggests that homeowners and higher-income groups may recognize the importance of getting ahead of the rising rate environment, while renters are keenly feeling the double constraint on home purchase affordability of rising house prices and rising interest rates.”

Despite the increase, the index remains slightly lower on a year-over-year basis. “Continued negative perceptions around homebuying conditions were offset in part this month by consumers’ increased sense of job security, which we believe is likely due to labor market tightness and declining COVID case counts,” Duncan said. “However, with recent geopolitical events creating additional economic uncertainty – including likely increasing inflationary pressure – we believe the additional headwinds will compound existing affordability constraints to further soften mortgage demand in the coming year.”

Duncan noted the survey took place between Feb. 1-22, before the Russian invasion of Ukraine.