ATTOM: 4Q Lending Falls at Fastest Pace in 3 Years

ATTOM, Irvine, Calif., said mortgage lending across the U.S. fell in the fourth quarter, marking the third straight quarterly decrease and at the fastest pace since 2019.

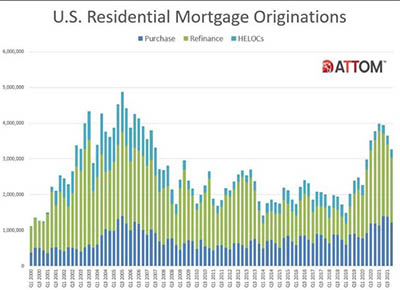

The company’s quarterly U.S. Residential Property Mortgage Origination Report said 3.27 million mortgages secured by residential property originated in the fourth quarter, down by 11 percent from the third quarter and by 13 percent from a year ago.

Mortgages issued fell for the third straight quarter; the annual decrease marked the largest since late 2018. The overall drop-off resulted from across-the-board quarterly declines in all three categories of conventional loans – purchase, refinance and home-equity. Only purchases lending remained up from a year earlier.

The report said overall, lenders issued $1.06 trillion in mortgages in the fourth quarter, down quarterly by 9 percent and annually by 7 percent. Both decreases in the dollar volume of loans were the largest since the early part of 2019.

On the refinance side, 1.81 million home loans rolled over into new mortgages during the fourth quarter, down 11 percent from the third quarter and 23 percent from a year earlier. Refinance mortgages decreased for the third straight quarter, while the annual drop was the largest in three years. Dollar volume of refinance loans fell by 9 percent from the third quarter and 18 percent annually, to $578 billion. ATTOM said refinance mortgages, while still a majority of residential lending activity, decreased again as a portion of all loans during the fourth quarter; they represented 55 percent of all fourth-quarter mortgages, down from 56 percent in the third quarter and 62 percent a year ago.

Purchase loans also declined in the fourth quarter; lenders issued 1.22 million mortgages to buyers, down 11 percent quarterly, although still up annually by 3 percent. Dollar value of loans taken out to buy houses and condominiums dipped to $439 billion, down 10 percent from the third quarter but still up 14 percent from a year ago. As a portion of all lending, purchase loans slipped from 38 percent in the third quarter to 37 percent in the fourth quarter 2021, while still up annually from 32 percent.

Home-equity lending also dropped quarterly, by 5 percent, to 230,700, although that number represented a slight increase in the total portion of all loans.

Todd Teta, chief product officer with ATTOM, said the decrease in all three mortgage categories during the fourth quarter, as well as the third straight drop in total lending, represented another sign that the near-tripling of lending activity from 2019 through 2021 has ended, at least temporarily.

“The receding volume of business for the residential mortgage industry is now showing up across all major categories of loans and appears to be more than just a temporary slide,” Teta said. “The ebbing wave of refinance loan that started in early 2021 has fully spread to home-purchase and home-equity lending. No doubt, total lending levels are still up over normal amounts over the past decade. And the drop-off in purchase loans seems to flow from a lack of housing supply rather than the housing market boom ending. But declining business for lenders remains a key point to watch in assessing the state of the market, especially with interest rates likely to climb this year.”