Supply Chain Restraints Hamstring February New Home Sales

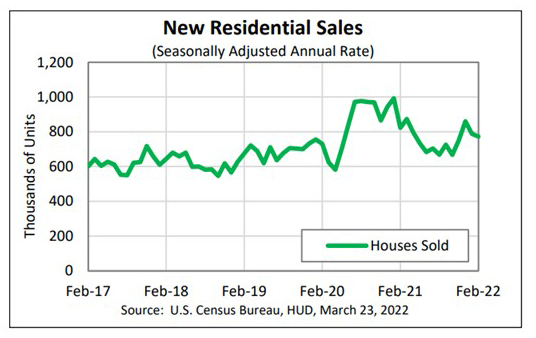

February new home sales fell by 2 percent from January as home builders continued to face supply chain bottlenecks, HUD and the Census Bureau reported Wednesday.

The report said sales of new single‐family houses in February fell to at a seasonally adjusted annual rate of 772,000, 2.0 percent below the revised January rate of 788,000 and 6.2 percent lower than a year ago (823,000).

Regionally, results were mixed. In the largest region, the South, sales fell by 1.7 percent in February to 451,000 units, seasonally annually adjusted, from 459,000 units in January and fell by 3 percent from a year ago. In the West, sales fell by 13 percent in February to 194,000 units from 223,000 units in January.

In the Midwest, however, sales increased by 6.3 percent in February to 84,000 units, seasonally annually adjusted, from 79,000 units in January but fell by 19.2 percent from a year ago. And in the Northeast, February sales jumped by 59.3 percent to 43,000 units from 27,000 units in January and improved by 7.5 percent from a year ago.

Odeta Kushi, Deputy Chief Economist with First American Financial Corp., Santa Ana, Calif., said the report fell below consensus expectations for the second straight month.

“The outlook for new-home sales is dependent on the amount of new homes under construction and the demand for new homes,” Kushi said. “We need builders to build more homes simply because there remains a severe supply-demand imbalance in the housing market, driving up prices. But builders face supply-side headwinds that make it difficult and more costly to build. These costs are passed onto the buyer in the form of higher prices. In a rising rate environment, that makes affordability a big challenge for potential buyers.”

“The major issues holding back home sales are on the supply side,” said Mark Vitner, Senior Economist with Wells Fargo Economics, Charlotte, N.C. “Building material and labor shortages have led to uncertain completion times, which have forced most builders to limit sales to allow projects to catch up.”

Vitner said higher borrowing costs are sure to test home sales in coming months. “Higher mortgage rates are likely to continue to create a sense of urgency for prospective buyers in the near term, which could support sales in the months ahead,” he said. “If mortgage rates spike further, however, the steady erosion of affordability will surely weigh on home sales.”

Sales Price

The median sales price of new houses sold in February fell to $400,600 from $27,400 in January. The average sales price rose to $511,000 in February from $494,000 in January; the disparity in prices often reflects regional differences.

For Sale Inventory and Months’ Supply

The seasonally adjusted estimate of new houses for sale at the end of February rose to 407,000 in February from 398,000 in January. This represents a

supply of 6.3 months at the current sales rate. “However, almost all of that increase occurred in homes which have yet to start construction,” Vitner said.