Mark P. Dangelo: The Rapid Phase Shift of Organizational Competencies and Operational Mindsets

Mark P. Dangelo is Chief Innovation Officer with Innovation Expertus, Cleveland, Ohio, responsible for leading and managing global experiential teams for business transformations, digital projects and innovation-based advisory services. He is also president of MPD Organizations LLC and an adjunct professor of graduate studies in innovation and entrepreneurship at John Carroll University. He is the author of five innovation books and numerous articles and a regular contributor to MBA NewsLink. He can be reached at mark@mpdangelo.com or at 440/725-9402.

Financial services and mortgage firms were created on the transactional model—deposits, loans, savings, investments and yes, foreclosures and bankruptcies. FSM leaders crafted derivations of traditional paper-based transactions (e.g., e-paper) moving them into the digital world often with little purpose except for digitization.

FSMs have wrestled with the realities that their transactional mindsets and cultures which underpinned processes, are now material impediments with customers demanding digitally integrated solutions—not just one-off products and services. In short, FSM offerings are increasingly part of a financial supply chain that not only spans financial firms, but also non-traditional partners and technology offerings. FSMs, because of digital transformations, are now competing against and partnering with a larger ecosystem of digital interactions, regulatory compliance and customer behaviors that were unfathomable prior to 2017.

Additionally, the rise of FinTech solutions has ushered in a digital revolution across finance and mortgage that is permanently transforming processes, and the data leveraged across financial services and mortgage. When combined with cross-industry capabilities, information, and technologies, the potential to fully embrace the expectations of the evolving Metaverse[i] rises not just for FSMs but also for digitally savvy customers who shun branches, subscribe to ESG (environment, social, governance) principles, and live their lives using mobile and virtual solutions.

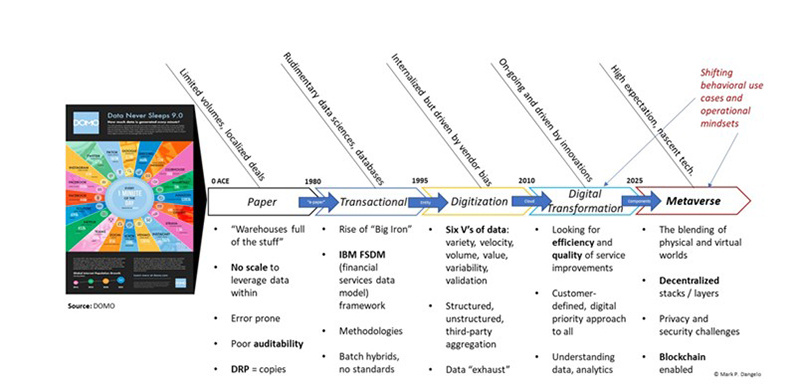

For FSMs, we can assess the situation in the following visual as pressures of today (left side) push the transactional mindset into digitally layered solution stacks that alter offerings, channels, and value propositions.

[ii] To level set FSM importance of the Metaverse, it is a macro term we will be hearing about for the remainder of the decade especially in financial services where we lose nearly 2,000 branches per year and one brand every 36 hours, as banking as a service rises with over 70% of customers preferring digital over physical.

For FSMs now questioning their fate in a global economy against world events including the unwinding of “toxic” partnerships and offerings, digital transformations offer additional roadmap alternatives for strategy and technology benefits. However, before we invest in likely technologies and obtain required skills, have we articulated and created the “use cases” of our solutions? Is there a clear mandate for change understood and accepted within the enterprise?

Transactional thinking was much simpler for IT and their enterprises—quicker, faster, cheaper driven by scale economic factors and using traditional prescriptions of success. Yet, rising solution set cultures and process have now impacted previous investments—e.g., cloud, SaaS, BaaS, AR, VR, AI, ML, “… lmnop”—and need to be framed across the touchpoints including the data exchanges and transformations. The interconnected solutions built on the premises of transactional mindsets were thought to create x-factor improvements and competitive benefits. However, as more solutions are offered, the benefits and risks of implementation—their implications of adoption—are now coming into focus thereby discounting long-established models of implementation.

To understand how digital transformations are continually altering the existing landscape of products, services, and organizational cultures, we must allow unfamiliar questions to be asked even with a significant potential to upend coveted FSM to vendor relationships. To leverage the positive value of digital transformation when it comes to FSMs and the Metaverse, we should challenge ourselves, “Are we asking the right questions.”

Additionally, are we open to accepting outcomes that are currently outside the scope of business to ensure that customers expectations and experiences regarding offerings remain innovatively relevant? Let’s explore a few of the challenge questions created from the impacts of digital transformations on the evolving FSM ecosystems and Metaverse—and the incremental steps that will happen as part of the end-state realization.

- What are the core competencies that will be demanded as part of merging of today’s discrete technologies into layers of compartmentalized stacks, which are assembled using technology and strategy methods like orchestration and containerization?

- What are the audit demands (external and internal) that will impact standards including rapidly expanding private, permissioned, and public blockchains (which could be used to secure the information exchanges and regulatory compliance demands)?

- Are we asking the right questions against a growing number of current business practices that are disintermediating processes and commoditizing traditional products and services?

- As ML, AR, VR and AI gain in their capability and feature rich “intelligence,” how will we include or account for the 60% of data now held outside of FSM enterprise clouds and vendor silos?

- How will the rise of smart contract solutions not only aid with mortgage asset digitization, but will these capabilities reduce the cost of originations, the time required to close, and the services of assets to meet rising investor demands regarding integrity, currency, legality, and profitability?

- Are we proposing a prescription of one-size fits all or are we delivering a framework that expands as data expands, customer needs change, and digital diversity exposes risks?

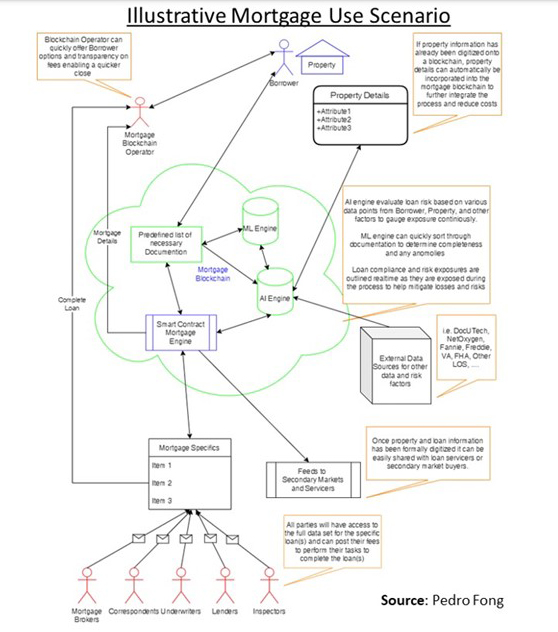

As an example of why FSM must evolve out of their transactional thinking can been seen in the current push of the blockchain mortgage. Whereas the rationale is sound, and the technology kinks anticipated to be solved by 2023, its adoption is seen as the primary goal.

However, if we look at vast number of implications that touch the initial adoption, we can see that blockchain alone will not make FSM transactional metamorphosis successful. These up-and-downstream implications arise not because of blockchain, but due to a blockchain mortgage as part of the broader data economy that exists[i] and which is rapidly evolving. This also creates a core competency demand for FSM groups to instill adaptability into their architectural implementation stacks beyond their initial provisioning processes.

The movement from transactional to solution sets can be witnessed across current market influencers—many of which are FinTech’s and non-traditional firms. This differentiation is frequently created using strategy and technology architectural methods to build stacks of products and services that can be assembled and disassembled to include new innovations and well as account for ecosystem shifts (e.g., Russian decoupling, digital twin analysis, MAD-mergers, acquisitions, and divestures).

The following visual showcases a potential alternative of how adaptative solutions, such as blockchain, could be used within a digital mortgage solution focused on a possible use scenario. Whereas there are dozens of traditional transactions flowing between the landing pads, they represent larger use cases that transcends traditional FSM functionality, and often, individual firms.

[i] Use of this constitutes not only traditional IT and data infrastructures, but additional privacy, security, regulatory compliance, legal, environmental, social, governance, curations and emerging digital enabling offerings such as quantum computing and Metaverse.

As noted, to achieve layered use scenarios, key methods and competencies must be not only practiced but internalized including compartmentalization, encapsulation, containerization, and orchestration (CECO). Each of these methods are robust discussions on their own, but they are linked using agile and iterative techniques to adopt engineering progression of crawl, walk, and run. CECO forms the base for mindset shifts in how technology is adopted as well as identify new core skills and capabilities that will need to be added as part of iterative adaptations.

In summary, as digital transformations progress, so will the practices of solution sets and their likely stacks that will be used to create uniquely defensible offerings. While the pace of innovations will continue to arrive daily, their adoption should be included as part of a use case mindset that moves the discussions back to business and the customers—not just because it is sophisticated and new. The cornerstone for FSM sustainability and relevance across the data economy will reside in how well they refocus their mindsets and adopt new core competencies that no longer are concentrated on a product or service. The transaction mindset must give way to solution set competencies and its stackable designs.

[i] To level set FSM importance of the Metaverse, it is a macro term we will be hearing about for the remainder of the decade especially in financial services where we lose nearly 2,000 branches per year and one brand every 36 hours, as banking as a service rises with over 70% of customers preferring digital over physical.

[ii] Use of this constitutes not only traditional IT and data infrastructures, but additional privacy, security, regulatory compliance, legal, environmental, social, governance, curations and emerging digital enabling offerings such as quantum computing and Metaverse.

(Views expressed in this article do not necessarily reflect policy of the Mortgage Bankers Association, nor do they connote an MBA endorsement of a specific company, product or service. MBA NewsLink welcomes your submissions. Inquiries can be sent to Mike Sorohan, editor, at msorohan@mba.org; or Michael Tucker, editorial manager, at mtucker@mba.org.)