Employment Data Positive Ahead of Friday’s Jobs Report

Two key indicators of U.S. employment—the ADP National Employment Report and the Labor Department’s Initial Claims report—showed improvement ahead of this morning’s Employment report from the Bureau of Labor Statistics.

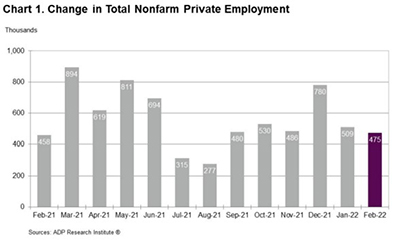

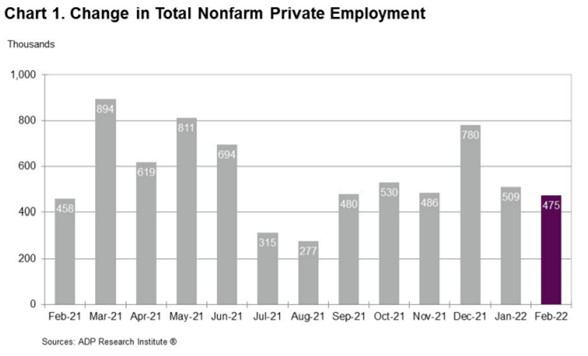

On Wednesday, ADP, Roseland, N.J., reported private-sector employment increased by 475,000 jobs between January and February, nearly matching the previous month’s report. And BLS on Thursday reported initial claims for unemployment insurance fell by another 18,000 last week to the lowest total so far in 2022.

ADP said by company size, small businesses (1-49 employees) lost 96,000 jobs in February; medium businesses (50-499 employees) added 18,000 jobs, while large businesses added 552,000 jobs. By sector, goods-producing businesses added 57,000 jobs, while service-providing businesses added 417,000 jobs. Of the latter, financial activities businesses added 11,000 jobs.

“Hiring remains robust but capped by reduced labor supply post-pandemic,” said ADP Chief Economist Nela Richardson. “Last month large companies showed they are well-poised to compete with higher wages and benefit offerings, and posted the strongest reading since the early days of the pandemic recovery. Small companies lost ground as they continue to struggle to keep pace with the wages and benefits needed to attract a limited pool of qualified workers.”

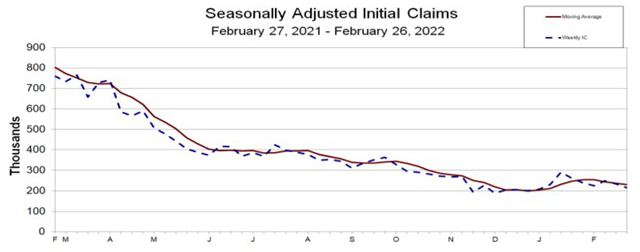

Meanwhile, for the week ending February 26, the Labor Department reported the advance figure for seasonally adjusted initial claims fell to 215,000, a decrease of 18,000 from the previous week’s revised level to its lowest level so far in 2022. The previous week’s level revised up by 1,000 from 232,000 to 233,000. The four-week moving average fell to 230,500, a decrease of 6,000 from the previous week, which revised up by 250, from 236,250 to 236,500.

The advance seasonally adjusted insured unemployment rate was unchanged at 1.1 percent for the week ending February 19. The advance number for seasonally adjusted insured unemployment during the week ending February 19 rose to 1,476,000, an increase of 2,000 from the previous week, which revised down by 2,000 from 1,476,000 to 1,474,000. The four-week moving average fell to 1,539,500, a decrease of 36,250 from the previous week’s revised average to its lowest level since April 4, 1970, when it was 1,516,000.

The advance number of actual initial claims under state programs, unadjusted, totaled 194,693 in the week ending February 26, a decrease of 21,285 (9.9 percent) from the previous week. The seasonal factors had expected a decrease of 2,985 (1.4 percent) from the previous week. Labor reported 756,629 initial claims in the comparable week in 2021.

The advance unadjusted insured unemployment rate fell to 1.3 percent during the week ending February 19, a decrease of 0.1 percentage point from the prior week. The advance unadjusted level of insured unemployment in state programs totaled 1,858,860, a decrease of 51,966 (2.7 percent) from the preceding week. The seasonal factors had expected a decrease of 53,662 (2.8 percent) from the previous week. A year earlier the rate was 3.4 percent and volume was 4,848,404.

The total number of continued weeks claimed for benefits in all programs for the week ending February 12 fell to 1,971,279, a decrease of 62,625 from the previous week. Labor reported 18,593,212 weekly claims filed for benefits in all programs in the comparable week in 2021.

This morning (8:30 a.m. ET), BLS releases its monthly Employment Situation report for February. Mortgage Bankers Association Chief Economist Mike Fratantoni will provide commentary and analysis in the Monday, Mar. 7 edition of MBA NewsLink.