Industrial Real Estate Construction Reaches Record

Transwestern, Houston, said industrial real estate construction volume set a record in the first quarter as demand for the sector intensifies.

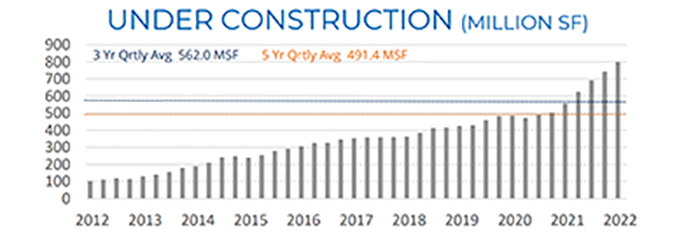

The firm’s first quarter U.S. Industrial Market Report said industrial product under construction soared to 800 million square feet, up nearly 250 million square feet from a year prior and 66 percent higher than pre-pandemic levels.

“The magnitude of product under construction nationwide underscores the unsatiable demand for industrial real estate,” said Matt Dolly, Research Director with Transwestern. “Rents continue to increase as markets are reporting record low vacancy rates–in some areas essentially zero for modern, well-equipped space.”

Dolly said e-commerce and supply chain disruption will continue to drive new industrial development, “however, land constraints and increased regulation will likely prompt new development toward markets with less dense population centers,” he noted.

The report said fewer than 100 million square feet of new industrial product delivered for the first time since first-quarter 2021. Constrained supply pushed the average industrial asking rent to $7.39 per square foot. Of 44 markets Transwestern tracked, 23 reported double-digit rent hikes, with five markets exceeding 20 percent: East Bay-Oakland, Calif. (35.4 percent); Los Angeles (32.4 percent); Las Vegas (27.0 percent); Philadelphia (20.9 percent); and Tampa, Fla (20.9 percent).

The Sun Belt continues to experience “striking” growth, the report noted, with Savannah, Ga., Charleston, S.C. and Phoenix all reporting under construction stock exceeding 10 percent of total inventory.

Vacancy dropped to 4.1 percent during the quarter, its sixth consecutive decrease. Five markets reported direct vacancy at or below 2.0 percent, including California’s Inland Empire, Savannah, Ga., Los Angeles, Orange County, Calif., and Las Vegas. Other supply-constrained markets with less than 3.0 percent of unoccupied space included Columbus, Ohio, Miami and New Jersey.

Industrial occupancy grew by 110 million square feet, making early 2022 the sixth consecutive quarter with occupancy growth surpassing 100 million square feet. When looking at 12-month totals, occupancy growth was higher for more than 95 percent of tracked markets compared to their three-year average.

“Insufficient supply in several core markets contributed to the deceleration in occupancy gains during the past three months,” Dolly said. “We anticipate sustained growth as new product comes online.”