Pending Home Sales Edge Higher

Chart courtesy of National Association of Realtors

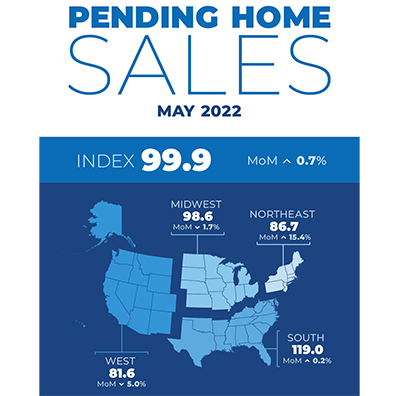

Pending home sales broke a six-month skid last month with a slight 0.7 percent rise from April.

The National Association of Realtors reported pending home sales ended a six-month streak of declines. Regionally, month-over-month results were mixed as the Northeast and South experienced increases while the Midwest and West posted decreases. Year-over-year contract activity slid in all four major regions.

The Pending Home Sales Index, a forward-looking indicator of home sales based on contract signings, inched up 0.7 percent to 99.9 in May. Year-over-year, transactions dropped 13.6 percent. An index of 100 equals the level of contract activity in 2001.

“Despite the small gain in pending sales from the prior month, the housing market is clearly undergoing a transition,” said NAR Chief Economist Lawrence Yun. “Contract signings are down sizably from a year ago because of much higher mortgage rates.”

According to NAR, at the median single-family home price and with a 10 percent down payment, the monthly mortgage payment has increased by about $800 since the beginning of the year as mortgage rates have climbed by 2.5 percentage points since January.

“Trying to balance the housing market by choking off demand via higher mortgage rates is damaging to consumers and the economy,” Yun said. “The better way to balance the market is through increased supply, which also helps the broader economy.”

First American Economist Ksenia Potapov noted a problem may be the ongoing lack of housing supply. Existing homes make up approximately 90 percent of inventory, but existing homeowners are staying put and the average homeowning tenure in the U.S. is over 10.5 years. “Fewer existing homeowners selling means fewer homes for sale and, ultimately, fewer sales,” she said.

Potapov noted existing homeowners may find themselves locked into golden handcuffs as mortgage rates increase. “They have little financial incentive to sell their home only to buy a new one at a much higher mortgage rate,” she said. “This is the rate lock-in effect.”

While the housing market remains unbalanced nationwide with demand far outpacing supply, Yun noted variations in home prices and affordability contributed to the regional differences in pending sales activity in May. “The largest decline in contract activity was observed in the West region, where homes are the most expensive,” he said. “This further indicates the growing need to increase supply to tame home price growth and improve the chances of ownership for potential home buyers.”