Luxury Home Sales See Biggest Decline Since Start of Pandemic

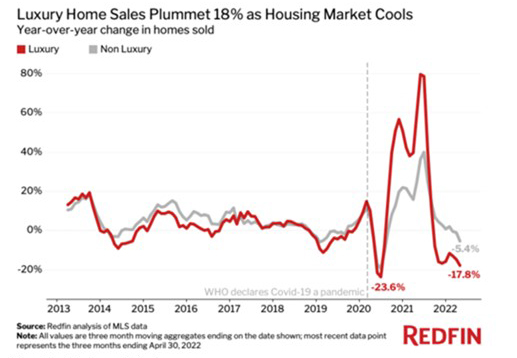

Redfin, Seattle, said sales of luxury U.S. homes fell 17.8% year over year during the three months ending April 30, the largest drop since the onset of the coronavirus pandemic sent shockwaves through the housing market.

By comparison, sales of non-luxury homes fell 5.4%.

Redfin said the luxury market is cooling as soaring interest rates, a tepid stock market, inflation and economic certainty put a damper on demand. For a luxury buyer, a higher mortgage rate can mean a monthly housing bill that’s thousands of dollars more expensive. The year-over-year cooldown is also a reflection of the market for high-end homes coming back to earth following a nearly 80% surge in sales a year ago.

Redfin said luxury-sales growth began to slow in the spring and summer of 2021 amid an extreme shortage of high-end properties for sale, which restricted how many homes could be sold. Although the inventory crunch has started to ease, the shortage of luxury homes on the market is still likely contributing to the drop in luxury sales.

“The pool of people qualified to purchase luxury properties is shrinking because the stock market is falling and mortgage rates are rising,” said Elena Fleck, a Redfin real estate agent in West Palm Beach, Fla. “The good news for buyers is the market is becoming more balanced and competition is easing up. Of course, that doesn’t help the scores of Americans who have been priced out altogether.”

Rising interest rates have triggered a slowdown in the housing market as a whole in recent weeks, Fleck noted. “I had one seller in Delray who went under contract on their home for over $2 million in March, right in the middle of an interest-rate hike,” she said. “The buyers backed out because they realized their mortgage payment would rise by more than $3,000 per month with the higher interest rate. They could no longer afford the house comfortably.”

Redfin said the median sale price of luxury homes rose by 19.8% year over year to $1.15 million during the three months ending April 30—roughly the same growth rate as non-luxury homes. While that’s still above pre-pandemic levels of less than 10%, it’s down from a peak of 27.5% in spring 2021.

The report said the inventory crunch in the high-end housing market is easing as the drop in sales leaves more homes available for purchase. The supply of luxury homes for sale fell 12.4% year over year during the three months ending April 30. That compares with a record decline of 24.6% during the summer of 2021, when there was still intense demand for high-end homes. The supply of non-luxury homes fell 8.4% during the three months ending April 30.

Redfin said luxury home sales fell in all but one of the top 50 metros. The biggest decline was in Nassau County, N.Y. (-45.3% YoY), followed by Oakland (-35.1%), Dallas (-33.8%), Austin, Texas (-33%) and West Palm Beach, Fla. (-32.8%). The only increase was in New York (+30%).

Redfin also reported homebuyer budgets are essentially flat from last year, up just 0.3% year over year nationwide in the three months ending April 30, the slowest growth rate since June 2020.

Redfin Deputy Chief Economist Taylor Marr said declining budgets are a leading indicator that home-price growth has passed its peak and will slow in the coming months. The dip is also a sign that high mortgage rates are having a major impact on how much money buyers can spend on homes, with more of their budgets going toward interest payments.

Budgets hit peak growth at a rate of 12.2% in April 2021. That was three months before home-sale prices hit their peak growth, increasing a record 22.6% year over year in July 2021. Redfin economists expect the cooldown in budgets will lead a cooldown in price growth by two to three months, too, as buyers typically search online months before they purchase a home. Sellers are slower to adjust to the cooling market, but they are starting to react to buyers’ declining budgets: 21% of home sellers dropped their asking price in the last four weeks–up from 10% a year earlier.

Homebuyer budget growth started slowing at the beginning of this year. Budgets increased 5.1% year over year in December, and have declined every month since. The cooldown coincides with sharply rising mortgage rates. Mortgage rates hovered around 3% for most of 2021, and now they’re sitting around 5.2% after a record-fast increase that started in January.

With a 5.2% interest rate, a buyer on a $2,500 monthly budget can afford a home priced at $427,250. When rates were 3%, a buyer on the same budget could afford a $517,500 home.

“When mortgage rates go up, buyers’ budgets go down,” Marr said. “And when buyers’ budgets go down, sellers have to meet buyers where they are. Budgets haven’t fallen from a year ago and we don’t expect home-sale prices to fall, either. But the fact that budget growth has slowed so significantly is one sign among many that home-price growth will continue to slow as the year goes on.”