1Q Mortgage Lending Activity Sees Sharpest Decline in 8 Years

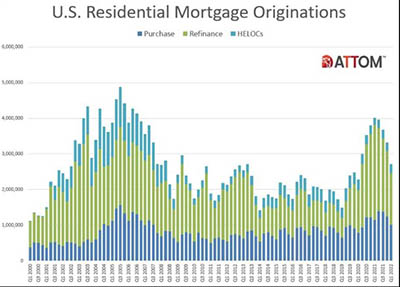

ATTOM, Irvine, Calif., said overall residential lending activity fell in the first quarter at an annual rate of 32 percent, marking the sharpest decline in eight years.

The company’s U.S. Residential Property Mortgage Origination Report said lenders originated 2.71 million single-family mortgages in the first quarter, down by 18 percent from the fourth quarter—the largest quarterly decrease since 2017 – and down 32 percent from a year ago – the biggest annual drop since 2014.

ATTOM attributed the decline, which marked the fourth straight quarterly decrease, to double-digit downturns in purchase and refinance activity, even as home-equity lending rose.

Overall, lenders issued $892.4 billion in mortgages in the first quarter, down quarterly by 17 percent and annually by 27 percent. The quarterly and annual decreases in the dollar volume of loans were the largest in five and eight years, respectively.

Not surprisingly, the biggest contributor to the downturn was a decrease in refinance deals. Just 1.45 million residential loans were rolled over into new mortgages during the first quarter of 2022, down 22 percent from the fourth quarter and 46 percent from a year earlier. Amid rising mortgage interest rates, the number of refinance mortgages decreased for the fourth straight quarter while the annual drop was the largest since 2014. The dollar volume of refinance loans was down 20 percent from the prior quarter and 42 percent annually, to $470.7 billion.

Refinancing, while still a majority of residential lending activity, also decreased again as a portion of all loans during the first quarter of 2022. They represented 53 percent of all first-quarter mortgages, down from 56 percent in the fourth quarter and 67 percent a year ago.

“The drop-off in Q1 refinancing activity is no surprise with mortgage rates rising as rapidly as they have,” said Rick Sharga, executive vice president of market intelligence with ATTOM. “But many forecasts expected purchase loans to remain strong in 2022, and even increase in both the number of loans originated and the dollar volume of those loans. The weakness in purchase loan activity shows just how much of an impact the combination of escalating home prices and rising interest rates have had on borrower activity this year.”

The report said purchase-loan activity shrank in the first quarter as lenders issued 1.01 million mortgages to buyers. That tally was down 18 percent quarterly and 12 percent annually. The dollar value of loans taken out to buy residential properties dipped to $371.3 billion, down 16 percent from the fourth quarter and 1 percent from a year ago. Despite those decreases, purchase loans remained at 37 percent of all loans in the first quarter and were still up annually from 29 percent.

In the one category that bucked the trend, home-equity lending went up 6 percent quarterly and 28 percent annually, to 249,900. HELOC mortgages represented 9 percent of all first-quarter residential loans, up from 7 percent in the fourth quarter of 2021 and 5 percent in the first quarter of last year.

“With affordability apparently slowing down demand from move-up homebuyers, we’re likely to see a continuing increase in HELOCs and cash-out refinance loans, as those homeowners tap into the record $27 trillion of equity to make improvements in their current properties,” Sharga said.

The report also noted mortgages backed by FHA rose as a portion of all lending for the third time in the past four quarters, accounting for 281,306, or 10.4 percent, of all residential property loans originated in the first quarter. That was up from 9.8 percent in the fourth quarter and from 8.9 percent a year ago. Residential loans backed by the U.S. Department of Veterans Affairs accounted for 152,733, or 5.6 percent, of all residential property loans originated in the first quarter, down from 6 percent in the previous quarter and 8.4 percent a year earlier. VA lending as a portion of all loans dropped for the sixth straight quarter.

The report said the median down payment on single-family homes and condos purchased with financing in the first quarter fell to $25,200, down 3.1 percent from $26,000 in the previous quarter but still up 24.4 percent from $20,250 a year ago. Among homes purchased with financing in the first quarter, the median loan amount rose to $295,075. That was up 0.7 percent from the prior quarter and up 11 percent from a year ago.