Home Values in ‘Opportunity Zones’ Keep Pace with National Gains

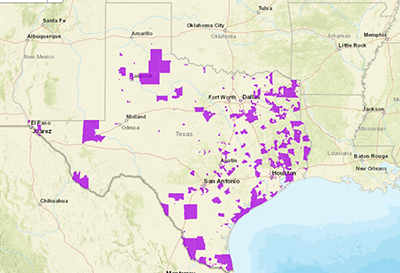

(Opportunity Zone map of Texas courtesy Texas Economic Commerce and Tourism Office.)

Home values in federal and state Opportunity Zone Redevelopment Areas—the controversial zones created in 2017 to spur economic development—are keeping up with nationwide home values, reported ATTOM, Irvine, Calif.

The ATTOM analysis of more than 5,000 Opportunity Zones, created by the Trump Administration and codified by Congress in the 2017 Tax Cut and Jobs Act, found median home prices rose again in the first quarter in a majority of Zones, with the pace of gains in half of all Zones surpassing nationwide quarterly and annual increases.

The report found median single-family home and condo prices rose from fourth quarter 2021 to first quarter 2022 in 55 percent of Opportunity Zones around the country and jumped by at least 20 percent annually in half. Those gains followed similar patterns over the past year, as home prices in distressed neighborhoods around the nation continue to keep up with gains in the broader national housing market.

While the pace of increases slowed in the first quarter compared to peak periods last year, median values still went up in about half the Opportunity Zones by more than the 16.6 percent year-over-year gain seen nationwide.

“Home price trends in Opportunity Zones mirror what we’re seeing elsewhere in the housing market,” said Rick Sharga, executive vice president of market intelligence at ATTOM. “Strong price growth has helped homeowners in these economically challenged areas benefit from higher equity, and should contribute to the ongoing redevelopment of these areas.”

Opportunity Zones are not without controversy. Opportunity Zones are defined in the Tax Act legislation as census tracts in or alongside low-income neighborhoods that meet various criteria for redevelopment in all 50 states, the District of Columbia and U.S. territories. Census tracts, as defined by the U.S. Census Bureau, cover areas that have 1,200 to 8,000 residents, with an average of about 4,000 people.

Intended to incent investors to commit to housing and business projects in designated “poor” neighborhoods, the Tax Cut and Jobs Act allowed them to sell stock or other investments and delay capital gains taxes, with profits exempt from federal taxes. However, the Opportunity Zones—identified by HUD and the Treasury Department—have been loosely defined, allowing many investors to get credit for other projects already started in non-designated Zones.

And, according to a New York Times analysis, instead of housing and job-creating businesses, “billions of untaxed investment profits are beginning to pour into high-end apartment buildings and hotels, storage facilities that employ only a handful of workers and student housing in bustling college towns, among other projects…Many of the projects that will enjoy special tax status were underway long before the opportunity-zone provision was enacted. Financial institutions are boasting about the tax savings that await those who invest in real estate in affluent neighborhoods.”

The ATTOM report noted typical home values in Opportunity Zones do remain lower than those in most other neighborhoods around the nation in the first quarter. Median first-quarter prices were less than the national median of $320,500 in 76 percent of Opportunity Zones, about the same portion as in earlier periods last year.

Typical values also were under $200,000 in 51 percent of the zones during the first quarter of 2022. That figure marked the same percentage as in the fourth quarter of 2021, but was down from 61 percent a year earlier, as markets inside some of the nation’s poorest communities kept improving amid a time of historically low mortgage rates, high buyer demand and tight supplies of homes for sale.

ATTOM said prices inside Opportunity Zones remained on an upward track during the first quarter as a decade-long price boom in the United States kept boosting markets throughout the U.S. Those included lower-income communities that have become more appealing as many buyers have gotten priced out of more-expensive neighborhoods.

“With so little entry level inventory on the market, homes in Opportunity Zones represent some of the few remaining affordable options for prospective homebuyers,” Sharga said. “This is especially important for first-time buyers, who typically have to stretch their finances in order to be able to afford a home.”

However, both the overall housing market and Opportunity Zones are facing headwinds today that didn’t exist a few months ago, as mortgage rates have risen to 5 percent, the stock market has fallen and consumer price inflation is at a 40-year high.