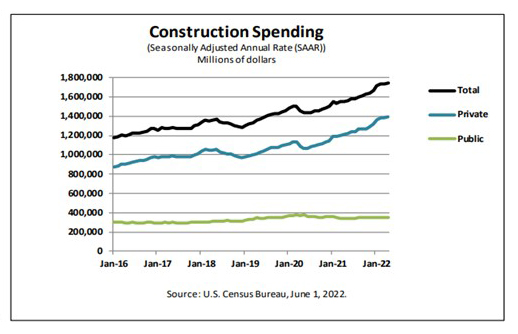

April Construction Edges Up

Construction spending improved slightly in April, by 0.2 percent from March—but below expectations., the Census Bureau reported Wednesday.

The report estimated construction spending in April at a seasonally adjusted annual rate of $1,744.8 billion, 0.2 percent higher than the revised March estimate of $1,740.6 billion. The April figure is 12.3 percent higher than a year ago (1,553.5 billion). During the first four months of this year, construction spending rose to $520.8 billion, 12.4 percent higher than the $463.3 billion for the same period in 2021.

Private Construction

Spending on private construction rose to a seasonally adjusted annual rate of $1,394.7 billion, 0.5 percent higher than the revised March estimate of $1,387.9 billion. Residential construction was rose to a seasonally adjusted annual rate of $891.5 billion in April, 0.9 percent higher than the revised March estimate of $883.5 billion. Nonresidential construction was at a seasonally adjusted annual rate of $503.2 billion in April, 0.2 percent lower than the revised March estimate of $504.4 billion.

Public Construction

The report estimated the seasonally adjusted annual rate of public construction spending rose $350.1 billion, 0.7 percent below the revised March estimate of $352.7 billion. Educational construction fell to a seasonally adjusted annual rate of $79.6 billion, 0.7 percent below the revised March estimate of $80.1 billion. Highway construction fell to a seasonally adjusted annual rate of $103.4 billion, 0.1 percent below the revised March estimate of $103.5 billion.

“Overall private spending increased 0.5% over the month, but a 0.7% decline in public spending took some of the wind out of the sails for total spending,” said Mark Vitner, Senior Economist with Wells Fargo Economics, Charlotte, N.C.

Vitner noted home improvement spending picked back up after declining in February and March. “Spending on additions and renovations has not downshifted substantially so far this year despite rising interest rates and homeowners spending less time at home as COVID risks subside,” he said.