Competition for Port Market Industrial Real Estate Heats Up

JLL, Chicago, reported port markets are emerging as the best bet for industrial real estate investors to place capital due to their positive rental growth profile.

With a 2.8 percent average vacancy rate, port markets rank well below the national average of 3.4 percent for industrial product as of March 31. Looking at new construction rates, 22.1 percent of new inventory constructed in the industrial market during the first quarter delivered in port markets.

“Both pent-up investor and occupier demand from the pandemic along with new buildings being delivered to the market have boosted asking rents,” said John Huguenard, Senior Managing Director and JLL Industrial Co-Leader in Capital Markets. “This ultra-competitive environment continues to drive average asking rents in port markets to new highs.”

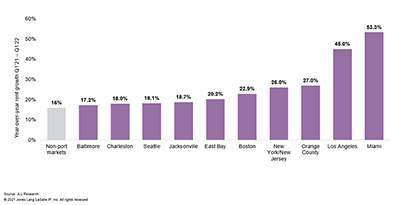

Port markets saw a 23 percent increase in asking rent year-over-year, while non-port markets rose 16 percent between first-quarter 2021 and first-quarter 2022, JLL reported. Miami led the port markets with a whopping 53.3 percent year-over-year increase in rental growth, followed by Los Angeles with 45 percent growth, Orange County with 27 percent, New York/New Jersey with 26 percent and Boston with 22.9 percent.

Recent interest rate increases have affected the sector, but the effects on pricing and overall investor demand will vary across markets, the report said.

“Industrial assets in port markets are trading for a premium,” said JLL Senior Managing Director Trent Agnew, Industrial Co-Leader in Capital Markets with Huguenard. “Despite the fact that port markets are more expensive, they still present themselves as a better long-term play for investors. The lack of available land for development, as well as other barriers to new supply, is expected to drive property fundamentals well beyond 2022.”

JLL said tenants with operations closely tied to ports are extending leases, causing demand surges as other tenants seek to enter the playing field. “This is especially evident in the Los Angeles and Long Beach industrial markets,” the report said. Additionally, markets near recently expanded ports are also experiencing the strongest growth in demand for industrial space.

“Despite a pandemic and global supply chain disruptions, many ports are seeing their busiest year ever for containers,” said Nick Rita, Manager of JLL Capital Markets Industrial Research. He noted Southeast ports are seeing significant jumps in cargo volume as congestions hinders other major ports along the West Coast.