Sponsored Content from WFG: When it Comes to Operational Efficiency, Don’t Let ‘Perfect’ Get in the Way of ‘Better’

After two years of unprecedented volume, a combination of rapidly rising interest rates, decreasing affordability, and limited inventory have brought refinance originations to a screeching halt. In the wake of such a precipitous drop, it’s now more important than ever for lenders to optimize profitability by finding ways to take time and cost out of the origination process.

With fintech at the forefront, it’s easy to get hung up on re-engineering and perfecting the entire loan origination process; however, it’s important not to let this “holy grail” ideal get in the way of making incremental changes that can net immediate, tangible benefits for all participants.

DecisionPoint® Instant Title Grading

To illustrate the point, WFG Lender Services began using the company’s proprietary DecisionPoint® instant title engine to grade title in 2019. Since implementation, WFG Lender Services’ clients have experienced tremendous lift in service-level performance and pull-through rates.

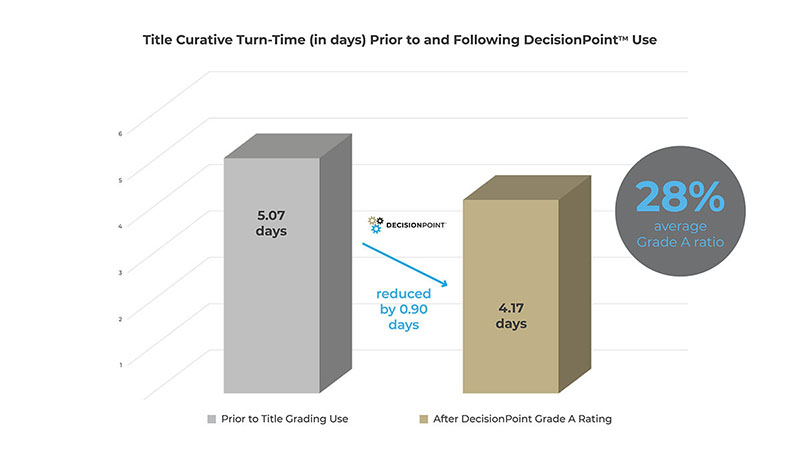

By focusing on acquiring property records and relevant data digitally and by leveraging systems integrations, DecisionPoint enables WFG Lender Services to deliver a fully searched title commitment and clear title within 48 hours of order receipt, reducing title processing times by at least one day. This reduction in title processing time has undoubtedly benefited WFG Lender Services clients by enabling them to kick-start loan processing and underwriting and ultimately close loans more quickly.

Based on ICE Mortgage Technology’s closing statistics for April 2022, loan closings average 48 days, so expediting the closing process by even just one day represents a 2 percent reduction in the mortgage origination cycle. While seemingly small, savings like these add up quickly and over time, particularly when margins are running so slim, since the entire savings can positively impact net per-loan profits.

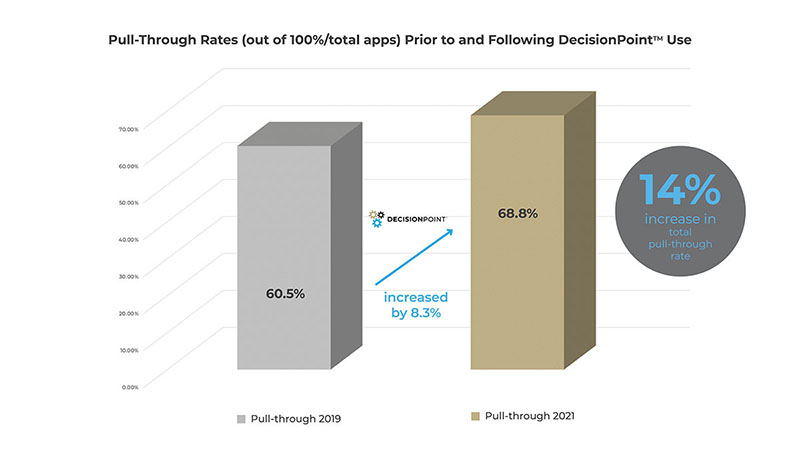

To put this savings in perspective, roughly 29 percent of all files opened are rated Grade A, allowing title to be cleared within 24 hours. Prior to implementing DecisionPoint, WFG’s lender partners were experiencing an average closing ratio of 60.5 percent. This ratio increased significantly to 68.8 percent following the implementation of the DecisionPoint title grading process. The result has been a 14 percent lift in the average pull-through rate for the company’s lender partners. Since these files require work regardless of whether or not they close, this significant increase in pull-through directly benefits lenders’ net income and profitability. Moreover, those same lenders saw their average days to close decline by two business days, from 46 and 53 days to 44 and 51 days, respectively.

Client-Centric Notary Panel

Another process improvement initiative that delivered substantial improvement in both customer satisfaction and post-closing error reductions is the implementation of client-specific notary panels. By implementing notary panels on behalf of several of its lender customers, WFG Lender Services’ Net Promoter Score (NPS) rating increased by a full 20 points over a 90-day period, positioning the company in the “World Class” range for customer satisfaction. The notary panel implementations also resulted in a significant reduction in post-close document errors, bringing them down from an average of five errors per file to less than two errors per file. In addition to the resulting time savings, a 60 percent reduction in post-closing document errors has not only further enhanced customer satisfaction by standardizing and optimizing the signing experience, but has also resulted in tangible savings for WFG Lender Services’ clients. Simply put, less closing errors means less post-closing clean-up work. Less post-close clean-up work means a reduced need for post-closing staff, reduced spend on post-closing vendors, and less document retention. It also minimizes the possibility of costly loan buy-backs. In other words, a better closing experience saves WFG Lender Services’ clients money.

This lift in NPS score and error reductions hasn’t just benefited WFG Lender Services, it has also directly benefited WFG’s lender customers. Lenders for whom WFG has implemented notary panels experienced similar increases in customer satisfaction ratings, a significant reduction in post-close documentation errors, and other meaningful cost savings.

Express Document Handling

Another area of incremental, but significant, improvement occurred when WFG Lender Services implemented its express document handling processes. Traditionally, executed loan documents were loaded into an envelope and simply dropped at the nearest mail carrier drop box to arrive sometime within the next “few days.” On occasion, these “few days” extended to a week or more and sometimes they never arrived at all. Consequently, for transactions where time is of the essence, a “few days” or more can be excruciating and result in funding delays and consumer complaints, which are only exacerbated if there are document errors that require corrections.

To resolve this issue, WFG Lender Services went well beyond requiring its signing agents to simply “fax back” critical documents. Instead, WFG Lender Services distributed signing agent training materials and established strict protocols requiring their signing agents to interact directly with the company’s production system; confirming the receipt of loan documents, completion of the signing and, most importantly, requiring signing agents to deliver the signed closing documents to WFG Lender Services electronically within a few hours of closing. By requiring signing agents to deliver executed loan documents electronically, post-closing document review is reduced from “a few days” after closing to just “a few hours” after closing.

As such, document errors are identified and corrected before the document package makes its journey of “a few days” through the mail. When documents are delivered, they are in their proper form (WFG Lender Services averages less than two errors per loan package), loan disbursement occurs on time, and lingering post-closing document issues are all but extinguished. Moreover, implementing this process enables WFG Lender Services to achieve on-time disbursement percentages that regularly exceed 99 percent.

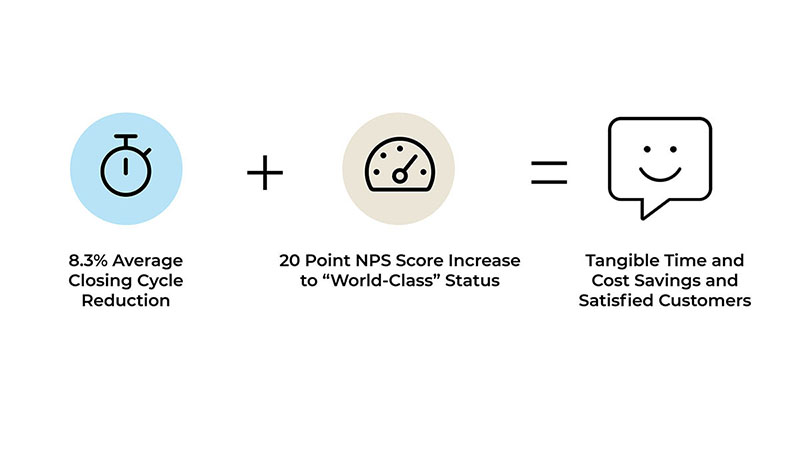

In Aggregate, Incremental Improvements Create Significant Efficiencies

When considered individually, each of these process enhancements resulted in measurable savings; however, when taken in aggregate, the benefits are truly impactful. For example, when combined, DecisionPoint and express document handling process implementations reduced the average loan closing cycle by 6.3 to 8.3 percent, or two full business days. Similarly, the deployment of lender-specific notary panels contributed to a full 20-point lift in WFG Lender Services’ NPS score, a “World Class” ranking. More importantly, these strategies also boosted customer satisfaction ratings for the company’s lender customers by providing their consumers with a better closing experience.

As the market shifts, WFG will continue to work in partnership with its lender customers and C-suite members of its Lender Executive Roundtable to identify pain points, and develop and implement solutions that solve them. By implementing incremental enhancements that improve pull-through, boost per-loan profitability, and enhance customer satisfaction, lenders can weather current market challenges and better position themselves for future success.

For more information about WFG Lender Services, contact about@wfgls.com, call 877-274- 3850, or visit wfgls.com.

(Sponsored content includes material submitted independently of the Mortgage Bankers Association and MBA NewsLink and does not connote an MBA endorsement of a specific company, product or service. For more information about sponsored content opportunities, contact Bill Farmakis at bill@jlfarmakis.com or 203/834-8832.)