CBRE: Office Lease Rates Highlight Flight-to-Quality Trend

CBRE, Dallas, said office rental trends indicate a “flight to quality” playing out across 12 major U.S. markets as companies adapt their workplaces for hybrid work.

“A flight to quality traditionally entails users and investors shifting to the highest quality properties in a commercial real estate sector due to an economic or industry upheaval,” CBRE said in its analysis. “In the office sector, that change has come in the past two years through widespread adoption of hybrid work.”

Office occupiers and investors now favor high quality offices as a strategy for encouraging employees to work from the office and equipping them to be their most productive when there, the report said.

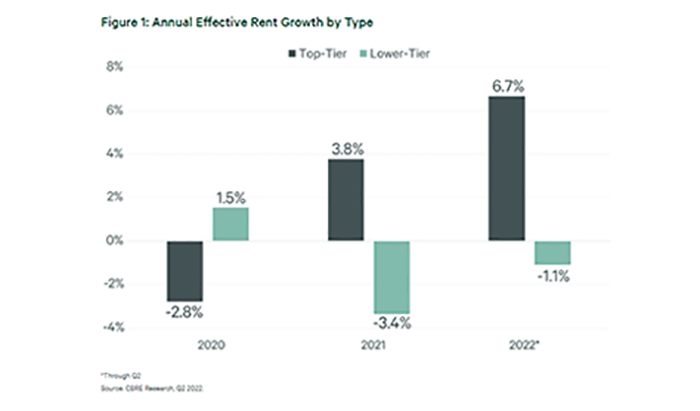

CBRE found average effective rents for top-tier properties increased by 3.8 percent in 2021 and by 6.7 percent so far this year. Conversely, average effective rents for lower-tier properties declined by 3.4 percent last year and by 1.1 percent so far this year.

“This data represents just one of many ways of assessing the flight-to-quality phenomenon, but it does provide a simplified, clear view for consideration,” said Mike Watts, President of Americas Investor Leasing with CBRE. “The data underscores that companies are investing more in their offices and owners are investing more in their buildings to get into the top tier and stay in it. Owners in lower tiers may need to get more aggressive in their pricing and concessions to generate sustained leasing velocity.”

CBRE focused on effective rents, which include concessions provided by building owners such as months of free rent and higher allowances for tenants to fit out their offices. It called an increase in such concessions a key factor in the declining lease rates for lower-tier properties.

“Granted, most analyses of flight-to-quality trends are subjective,” the report said. “There are not strict, universal definitions of Class A, B and C space. Companies can and do move to better space within the same quality category, especially in the A tier. And lease rates don’t always tell the full story: location, tenant mix, access to transportation corridors and other factors can play a role.”

Additionally, CBRE analyzed the flight-to-quality trend among Class A office buildings in downtown San Francisco in this year’s second quarter. That study found markedly better vacancy rates and lease rates in buildings CBRE defines as “prime Class A” versus those defined as “non-prime Class A.”