CoreLogic: Annual Single-Family Rent Growth Holds Steady at Record High in May

CoreLogic, Irvine, Calif., said annual U.S. single-family rent growth remained at a record high in May, posting a 13.9% increase from May 2021.

“This growth matched April’s increase, representing the first time that price growth did not accelerate from the previous month since January 2021,” CoreLogic said in its latest Single-Family Rent Index. The report noted sustained high rent prices are partially due to a robust labor market, with the national unemployment rate at 3.6% in May, the lowest recorded since before the start of the COVID-19 pandemic.

Additionally, rising interest rates are sidelining more prospective homebuyers, giving landlords a larger pool of potential tenants and thus more leverage to raise prices, the report said. The year-over-year U.S. single-family rent price growth was more than twice the May 2021 increase and more than eight times higher than the May 2020 growth.

“Increases in mortgage rates and high home prices can be headwinds to the for-sale housing market but may be continually pushing up single-family rents,” said Molly Boesel, Principal Economist with CoreLogic. “While the annual increase in the SFRI for May matched April’s growth rate, the gain remains at a record-high level. Furthermore, the month-over-month growth rate for rents in May was well above that month’s 19-year average.”

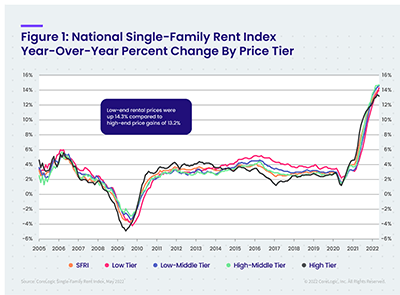

CoreLogic examines four tiers of rental prices. National single-family rent growth across the four tiers, and the year-over-year changes, were:

• Lower-priced (75% or less than the regional median): 14.3%, up from 4.7% in May 2021

• Lower-middle priced (75% to 100% of the regional median): 14.6%, up from 5.4% in May 2021

• Higher-middle priced (100% to 125% of the regional median): 14.7%, up from 5.8% in May 2021

• Higher-priced (125% or more than the regional median): 13.2%, up from 8.2% in May 2021

Miami posted the highest year-over-year increase in single-family rents among large metros at 39.5%, the tenth consecutive month it topped the nation for growth. Orlando, Florida and Las Vegas recorded the second- and third-highest gains at 24.8% and 16.7%, respectively. St. Louis (7.9%) and Honolulu (7%) posted the lowest annual rent price gains. “Differences in rent growth by property type emerged after COVID-19 took hold, as renters sought standalone properties in lower-density areas,” the report said. “This trend drove an uptick in rent growth for detached rentals in 2021, while the gains for attached rentals were more moderate. However, as rental inventory remains slim, the gap between attached and detached rental growth started to close last fall.”

Attached rental property prices grew by 13.4% year-over-year in May, compared to the 13.6% increase for detached homes. But detached rental prices have grown at a significantly higher rate over the past two years (24.4%) than attached rental prices (17.6%), CoreLogic reported.