Residential Construction Sees November Gains

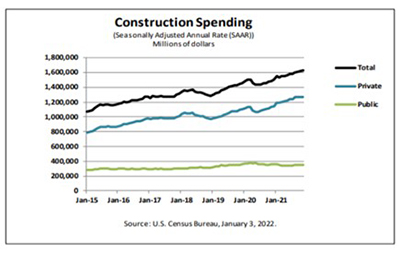

Construction spending rose in November, the Census Bureau reported Monday, boosted by an uptick on the residential side.

The report estimated overall construction spending at a seasonally adjusted annual rate of $1,625.9 billion, 0.4 percent higher than the revised October estimate of $1,618.8 billion and 9.3 percent higher than a year ago ($1,487.2 billion). During the first 11 months of 2021, construction spending rose to $1,463.2 billion, 7.9 percent higher than a year ago.

Private Construction

Spending on private construction rose to a seasonally adjusted annual rate of $1,273.6 billion in November, 0.6 percent higher than the revised October estimate of $1,265.8 billion. Residential construction rose to a seasonally adjusted annual rate of $796.3 billion in November, 0.9 percent higher than the revised October estimate of $789.1 billion. Nonresidential construction rose to a seasonally adjusted annual rate of $477.3 billion in November, 0.1 percent higher than the revised October estimate of $476.6 billion.

Public Construction

The report estimated the seasonally adjusted annual rate of public construction spending at $352.3 billion, 0.2 percent lower than the revised October estimate of $353.0 billion. Educational construction rose to a seasonally adjusted annual rate of $82.3 billion, 0.3 percent higher than the revised October estimate of $82.1 billion. Highway construction fell to a seasonally adjusted annual rate of $102.2 billion, 0.8 percent lower than the revised October estimate of $103.0 billion.

“Total spending is now up 9.3% on a year-over-year basis,” said Mark Vitner, Senior Economist with Wells Fargo Economics, Charlotte, N.C. “Construction activity continues to improve, despite continuing shortages of building materials and labor.”

Vitner noted while supply constraints continue to wreak havoc on project timelines and are adding to the rising cost environment, there are some signs material and worker shortages are beginning to ease as the industry enters into the seasonal slowdown during the winter months. He said home building appears to be strengthening against a backdrop of strong buyer demand and lack of homes for sale.

“The rise of the Omicron variant, however, may further disrupt global supply chain networks and exasperate labor scarcities, creating some downside risk,” Vitner said. “Flooding in Western Canada has also wreaked havoc on the lumber market.”

Vitner said public sector construction will likely be a growth area over the next few years. “State and local governments are now replete with cash from strong tax receipts and federal aid,” h said. “Looking further ahead, the recently enacted Infrastructure Investment & Jobs Act provides new spending for roads, bridges, mass transit, water and numerous other infrastructure projects, although much of the impact will not become apparent for a year or more.”