New Home Sales Finish 2021 on Solid Ground, But Down for Year

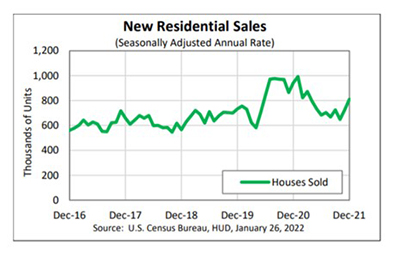

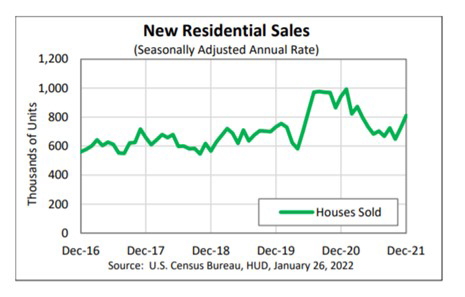

New home sales rose by nearly 12 percent in December, the highest level since last March, HUD and the Census Bureau reported Wednesday. Despite the improved numbers, however, sales were off from a year ago and 2021 sales fell by more than 7 percent from 2020.

The report said sales of new single‐family houses in December rose to a seasonally adjusted annual rate of 811,000, 11.9 percent higher than the revised November rate of 725,000, but 14 percent lower than a year ago (943,000).

Regionally, sales were largely positive. In the South, sales rose by nearly 15 percent to 456,000 units in December, seasonally annually adjusted, from 397,000 units in November; from a year ago, however, sales fell by 17.5 percent. In the West, sales rose by 0.4 percent to 242,000 units in December from 241,000 units in November and improved by 2.1 percent from a year ago.

In the Midwest, sales jumped by 56.4 percent to 86,000 units in December, seasonally annually adjusted, from 55,000 units in November but fell by 23.2 percent from a year ago. In the Northeast, sales fell by 15.6 percent in December to 27,000 units from 32,000 units in November and fell by 34.1 percent from a year ago.

HUD/Census estimated 762,000 new homes sold in 2021, 7.3 percent lower than 2020 (822,000).

“The [December] rise topped consensus expectations but was tempered somewhat by downward revisions to sales in both October and November,” said Mark Vitner, Senior Economist with Wells Fargo Economics, Charlotte, N.C. “Sales were likely bolstered by an increase in home completions last fall, particularly for more modestly priced homes. The bulk of the increase in sales, however, continues to come from sales of homes where construction has not yet started or from homes currently under construction.”

Vitner noted the drop in annual sales reflects the impact of ongoing supply chain bottlenecks which have lengthened the timeline for building new homes. “Supply chain bottlenecks eased up a bit last fall, which allowed more homes to be completed, but then worsened later in the year following devastating floods in western Canada which put further strains on lumber,” he said. “December’s jump in new home sales also likely reflects efforts by home buyers to stay a step ahead of rising mortgage rates.”

“Buyer FOMO [Fear of Missing Out] helps home builders close 2021 with blow-out December,” said Odeta Kushi, Deputy Chief Economist with First American Financial Corp., Santa Ana, Calif. “The outlook for new-home sales is largely dependent on the amount of new homes being built and the demand for new homes. Demand for new homes will remain strong due to the millennial demographic tailwind. The lack of existing homes for sale nationwide to meet this demand is supportive of new construction. Indeed, you can’t buy what’s not being built.”

“Though a higher interest rate environment presents downside risk to our new home sales forecast, overall we believe this report to be an encouraging sign that more new homes will soon be hitting the market,” said Doug Duncan, Chief Economist with Fannie Mae, Washington, D.C.

The report said the median sales price of new houses sold in December rose to $377,700. The average sales price rose to $457,300. The seasonally adjusted estimate of new houses for sale at the end of December rose slightly to 403,000, representing a supply of six months at the current sales rate.

“The latest construction data show builders currently have 769,000 single-family homes under construction, which is the highest since January 2007,” Vitner said. “With so many homes under construction, it is not surprising that homes under construction have accounted for a growing share of new home sales.”