Index Cites Gains in Home Buyer Assistance Programs

Down Payment Resource, Atlanta, said results of its latest Homeownership Program Index showed measurable quarter-over-quarter gains in program funding levels and an increased prevalence of programs aimed at assisting community heroes.

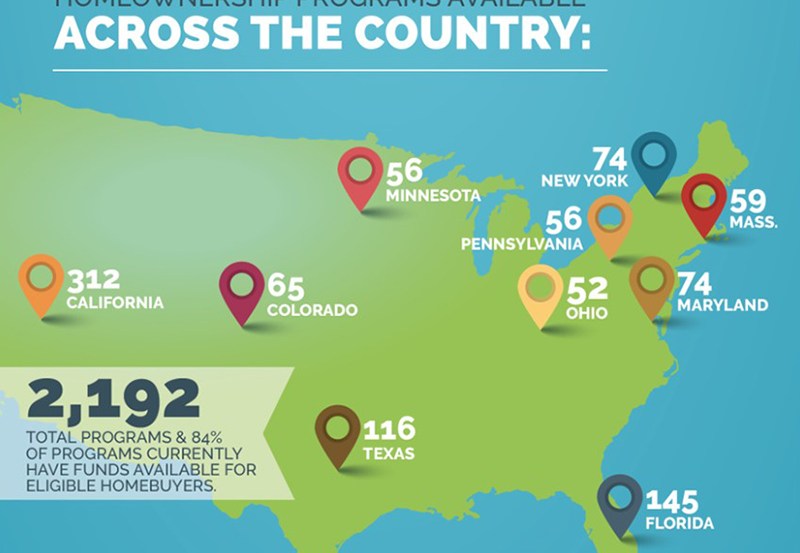

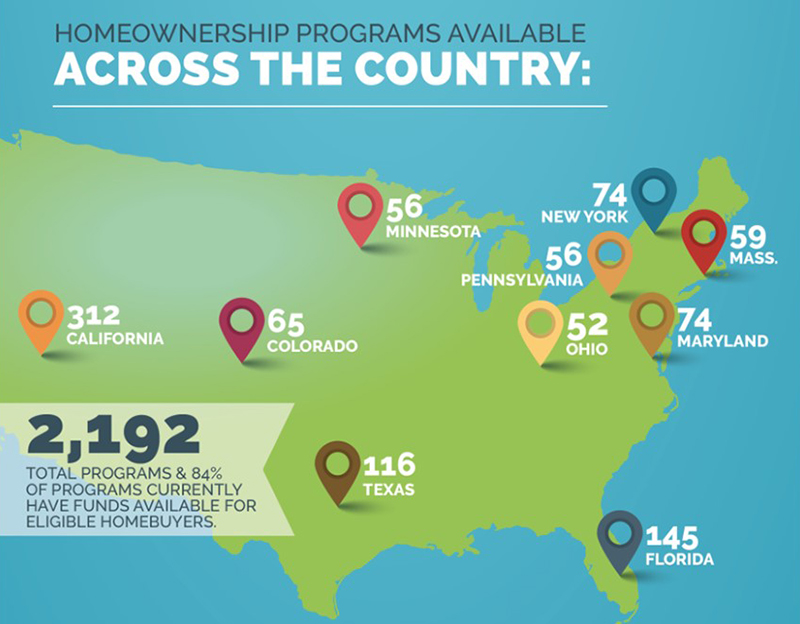

The Q4 2021 HPI examined a total of 2,192 homebuyer assistance programs that were active as of January 6, 2022. It found funding levels are on the rise, with 84% of programs had funds available for eligible homebuyers. That level of funding reflects a nearly 2% increase from Q3 2021.

Additionally, the survey found more programs now target community heroes. Nearly 9% of all homebuyer assistance programs available in Q4 benefit teachers, first responders, law enforcement officers, firefighters, healthcare workers and other providers of critical community services. Another 11% of programs offer benefits for veterans, members of the military and surviving spouses. Other survey findings:

–Three of four programs (73%) focus on helping homebuyers with down payments and/or closing costs. This figure includes repayable, partially forgivable and fully forgivable programs. Other major categories of assistance include affordable first mortgage programs (11%), Mortgage Credit Certificates (5%), matched savings programs and Housing Choice Vouchers.

–Assistance is available for repeat homebuyers and landlords. The report said 38% of programs do not have a first-time homebuyer requirement. In addition, 27% of programs allow buyers to purchase a multi-family property as long as the buyer occupies one of the units.

–Availability varies by location. Three out of four (74%) programs are targeted to properties in specific locales such as cities, counties or neighborhoods, with the balance of programs available statewide through state housing finance agencies. The states with the most homebuyer assistance programs are California, Florida and Texas.

–Support for manufactured housing is increasing. While homebuyer assistance programs have historically favored site-built homes, as of Q4, 28% of programs allow manufactured housing as an eligible property type, up nearly 2% from the previous quarter.