December Builder Applications Slow

Mortgage applications for new home purchases fell in December, continuing a slowing pattern, the Mortgage Bankers Association reported Thursday.

The MBA Builder Application Survey reported mortgage applications for new home purchases decreased by 5 percent in December from January and by 7.1 percent from a year ago. (Changes do not include any adjustment for typical seasonal patterns).

By product type, conventional loans composed 77.2 percent of loan applications, FHA loans composed 12.6 percent, RHS/USDA loans composed 0.4 percent and VA loans composed 9.8 percent. The average loan size of new homes increased from $414,114 in November to $423,102 in December.

“Applications to buy a new home slowed in December, while the activity remained tilted to higher-priced homes,” said Joel Kan, MBA Associate Vice President of Economic and Industry Forecasting. “Supply chain challenges, labor shortages and higher materials costs also contributed to last month’s decline, as projects were delayed or cost more to complete. The average loan size set another survey record at $423,102, as these higher costs are pushing sales prices higher.”

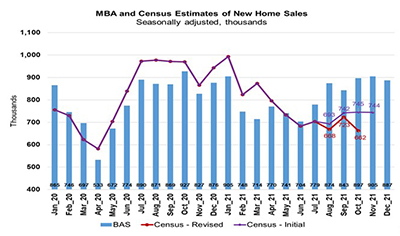

MBA estimated new single-family home sales at a seasonally adjusted annual rate of 887,000 units in December, based on data from the BAS, a decrease of 2 percent from the November pace of 905,000 units. On an unadjusted basis, MBA estimated 60,000 new home sales in December, a decrease of 7.7 percent from 65,000 new home sales in November.

The new home sales estimate is derived using mortgage application information from the BAS, as well as assumptions regarding market coverage and other factors.

The MBA Builder Applications Survey tracks application volume from mortgage subsidiaries of home builders across the country. Using these data, as well as data from other sources, MBA provides an early estimate of new home sales volumes at the national, state and metro level. These data also provide information regarding types of loans used by new home buyers. Official new home sales estimates are conducted by the Census Bureau on a monthly basis. In those data, new home sales are recorded at contract signing, which is typically coincident with the mortgage application.

For additional information on the MBA Builder Applications Survey, click here.