Office Occupancy, Rent Growth Move into Positive Territory

The office market may be turning a corner following five consecutive quarters of negative net absorption, reported Transwestern, Houston.

“While the office market is still feeling the effects of the pandemic, key indicators such as positive net absorption and upticks in office-using job employment are telling of a sector that is headed toward recovery,” said Elizabeth Norton, Senior Managing Director of Research Services at Transwestern.

The Transwestern U.S. Office Market report said fourth-quarter net absorption registered 644,000 square feet, marking the first time the sector has reported occupancy growth since the onset of the pandemic.

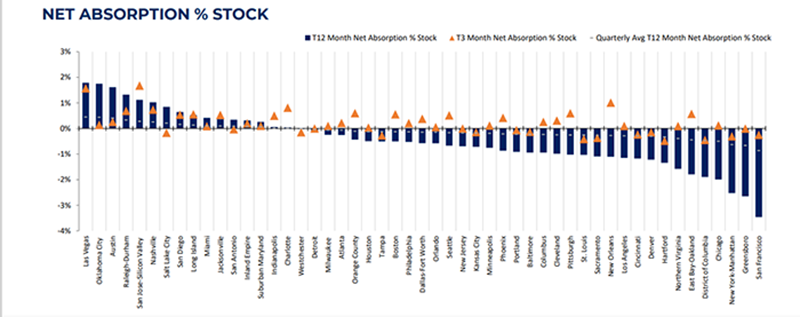

Boston, San Jose-Silicon Valley and Dallas-Fort Worth saw the most absorption with quarterly leasing activity totaling 1.64 million square feet, 1.61 million square feet and 1.21 million square feet, respectively, Transwestern said. Nearly a third of the 51 office markets tracked managed positive net absorption for full-year 2021, led by Las Vegas, Oklahoma City, Austin, Texas and Raleigh-Durham, N.C.

In another encouraging sign, Transwestern said 80 percent of tracked markets experienced net absorption above their quarterly average for the past year.

But other measures indicate there are still hurdles to overcome. “Uncertainty brought on by Omicron contributed to delayed space decisions and depressed transaction volume,” the report said. A dozen markets posted vacancy above 15 percent as more than 13 million square feet of new space was delivered. And available sublet space remains above pre-pandemic levels in all but three markets.

“Amid this uncertainty, landlords remain optimistic that pent-up demand will soon begin translating to leases and have relied on generous concessions rather than lower asking rents to secure tenants,” Transwestern said, noting the average national asking rent increased to $25.72 per square foot in the fourth quarter, reflecting 2.1 percent annual growth.

“In this environment, concessions have become a larger part of the story when it comes to market dynamics,” Norton said. “Also, the number of months in free rent edged up, despite term remaining level.”