Inflation Takes Toll on Small Business Optimism

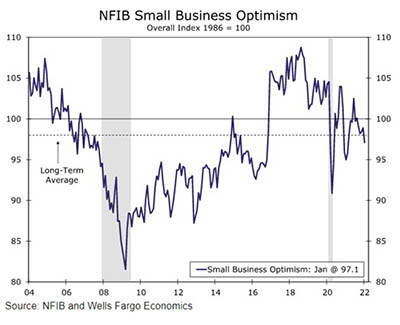

The National Federation of Independent Businesses Small Business Optimism Index decreased in January amid rising concerns over inflation’s impact.

The index decreased slightly in January to 97.1, down 1.8 points from December. The report said inflation remains a problem for small businesses, as 22% of owners reported that inflation was their single most important business problem, unchanged from December when it reached the highest level since 1981. The net percent of owners raising average selling prices increased four points to a net 61% (seasonally adjusted), the highest reading since the fourth quarter of 1974.

“More small business owners started the New Year raising prices in an attempt to pass on higher inventory, supplies and labor costs,” said NFIB Chief Economist Bill Dunkelberg. “In addition to inflation issues, owners are also raising compensation at record high rates to attract qualified employees to their open positions.”

“The NFIB survey was one of the first economic indicators to signal that inflation would prove to be far more menacing than the Fed or most private forecasters had been projecting,” said Mark Vitner, Senior Economist with Wells Fargo Economics, Charlotte, N.C. “The latest data suggest that inflation will get worse before it gets better. Small business also know that when inflation does get better, it will likely pressure business operating margins, which is a reason why such a large proportion of business owners remain pessimistic about the near-term economic outlook.”

Other survey findings:

–Owners expecting better business conditions over the next six months increased two points to a net negative 33%. Small business owners remain pessimistic about future economic conditions as this indicator has declined 13 points over the past six months.

–Forty-seven percent of owners reported job openings that could not be filled, a decrease of two points from December.

–Owners’ plans to fill open positions remain at record high levels, with a seasonally adjusted net 26% planning to create new jobs in the next three months, down two points from December and just six points below the highest reading in the 48-year history of the survey set in August.

–Fifty-eight percent of small business owners reported capital outlays in the last six months, up one point from December. Of those owners making expenditures, 40% reported spending on new equipment, 22% acquired vehicles, 15% improved or expanded facilities, 8% acquired new buildings or land for expansion, and 15% spent money for new fixtures and furniture. Twenty-nine percent of owners plan capital outlays in the next few months, unchanged from December and two points higher than the 48-year average.

–Five percent of owners reported lower average selling prices and 62% reported higher average prices. Price hikes were the most frequent in wholesale (88% higher, 3% lower), manufacturing (71% higher, 1% lower), retail (69% higher, 4% lower), and construction (67% higher, 5% lower). Seasonally adjusted, a net 47% of owners plan price hikes.