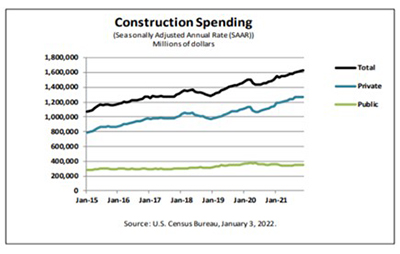

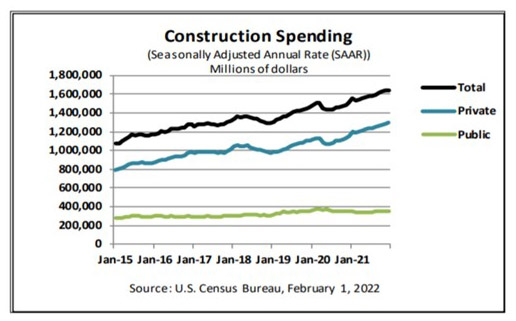

2021 Construction Spending Up 9%

Construction spending slowed a bit in December, but finished the year on a strong note, the Census Bureau reported Tuesday.

The report said construction spending came in at a seasonally adjusted annual rate of $1,639.9 billion in December, 0.2 percent higher than the revised November estimate of $1,636.5 billion. The December figure is 9.0 percent higher than a year ago ($1,504.2 billion). The value of construction in 2021 was $1,589.0 billion, 8.2 percent (±0.8 percent) above the $1,469.2 billion spent in 2020.

The report said spending on private construction rose to a seasonally adjusted annual rate of $1,292.9 billion, 0.7 percent higher than the revised November estimate of $1,283.8 billion. Residential construction was rose to a seasonally adjusted annual rate of $810.3 billion in December, 1.1 percent higher than the revised November estimate of $801.1 billion. Nonresidential construction was unchanged at a seasonally adjusted annual rate of $482.6 billion in December.

The value of private construction in 2021 rose to $1,242.8 billion, 12.2 percent higher than the $1,107.9 billion spent in 2020. Residential construction in 2021 rose to $774.9 billion, 23.2 percent higher than the 2020 figure of $628.9 billion; nonresidential construction fell to $467.9 billion, 2.3 percent below the $479.0 billion in 2020.

Census reported the estimated seasonally adjusted annual rate of public construction spending fell to $347.0 billion, 1.6 percent below the revised November estimate of $352.7 billion. Educational construction was at a seasonally adjusted annual rate of $81.0 billion, 1.4 percent below the revised November estimate of $82.2 billion. Highway construction rose to a seasonally adjusted annual rate of $103.5 billion, 0.1 percent higher than the revised November estimate of $103.4 billion.

The value of public construction in 2021 fell to $346.2 billion, 4.2 percent below the $361.2 billion spent in 2020. Educational construction in 2021 fell to $82.4 billion, 7.6 percent below the 2020 figure of $89.1 billion; highway construction rose to $99.7 billion, 0.2 percent above the $99.5 billion in 2020.

“Building material and labor shortages continue to cause delays and push input costs higher, bedeviling much of the construction industry,” said Mark Vitner, Senior Economist with Wells Fargo Economics, Charlotte, N.C. “The residential sector continues to have the wind at its back despite rising mortgage rates and a growing list of supply-side struggles.”

Vitner noted despite recent weakness, public construction is poised for stronger growth over the next few years. “In addition to the Infrastructure Investment and Jobs Act, which provides nearly $550 billion in new spending for a wide variety of infrastructure projects, state and local governments are flush with cash from strong tax receipts and previous rounds of federal aid,” he said. “Much of this spending is going into street improvements, greenways and streetscapes.”

Vitner also noted demand for new homes remains robust in the face of fast-rising home prices and modestly higher mortgage rates. “Strong buyer demand and historically low existing inventories are bolstering home builder confidence despite rampant building material and labor shortages,” he said. “A brief respite in lumber prices appears to have provided a boost to home construction last fall, but prices have since spiked as inventories grew tight again.”

Vitner said spending on home improvement projects slipped 0.1% in December. “Rising homeowner equity, low interest rates and more time being spent at home has led to a marked increase in renovation and remodeling projects over the past two years,” he said. “The long-running difficulty in finding workers and persistent shortages of assorted building materials are weighing more on home improvement spending, as more workers have returned to the workplace and slowed do-it-yourself projects.”

On the non-residential side, Vitner said the pandemic-induced rise of e-commerce and need for more resilient supply chains continues to boost demand for warehouses and manufacturing facilities. “The monthly gains in office and lodging spending are encouraging signs that the nonresidential categories hardest-hit by the pandemic are starting to see activity improve,” he said.