MBA Forecast: 2022 Commercial/Multifamily Lending to Hit Record $1 Trillion

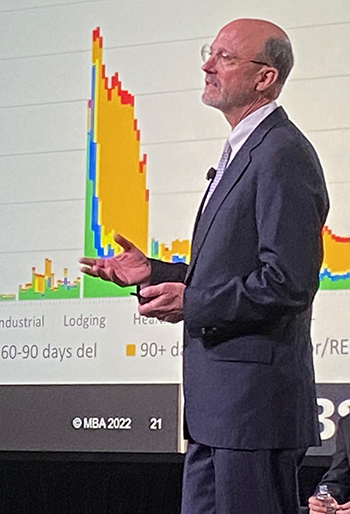

SAN DIEGO — Total commercial and multifamily mortgage borrowing and lending is expected to break $1 trillion for the first time in 2022, the Mortgage Bankers Association reported Monday at its 2022 Commercial/Multifamily Finance Convention and Expo.

That would represent a 13 percent increase from 2021’s estimated volume of $900 billion, MBA said.

“There is incredible strength in the commercial real estate market,” said Jamie Woodwell, MBA Vice President for Commercial Real Estate Research, during the Economic Forecast general session here at CREF22. “We think the fundamentals are there both on the valuation side as well as the rents, vacancies and other property fundamentals for the remainder of this year.”

Woodwell said 2021 was a “remarkable” year for commercial real estate markets. “And we expect 2022 to continue that momentum,” he said. “Commercial real estate lending volumes are closely tied to the values of the underlying properties. In 2021 those values rose by more than 20 percent, and those increases will fuel further demand for mortgage debt in the coming years.”

Woodwell said continued increases in property incomes and stability in the ways investors value those incomes, should also support solid demand for mortgage capital, even in the face of modest increases in interest rates.

The MBA commercial real estate finance forecast is updated this year to target total commercial real estate lending. In past years, the forecast targeted lending by dedicated commercial/multifamily lenders, which excluded mortgages made by many smaller and midsized depositories. Lending volumes in this year’s forecast incudes those institutions.

MBA said multifamily lending alone (which is also included in the total figures above) is forecast to rise to a record $493 billion in 2022 – a 5 percent increase that surpasses last year’s record total of $470 billion. MBA anticipates borrowing and lending to remain high in 2023, with slightly more than $1.0 trillion of total commercial real estate lending and $474 billion in multifamily lending.

For additional commentary on the pandemic’s impact on the sector, visit MBA’s Commercial/Multifamily Market Intelligence Blog: https://www.mba.org/news-research-and-resources/research-and-economics/commercial/-multifamily-research.

MBA’s commercial/multifamily members can download a copy of MBA’s latest Commercial/Multifamily Real Estate Finance Forecast at www.mba.org/crefresearch.