CoreLogic: Single-Family Rent Growth Triples Year Over Year

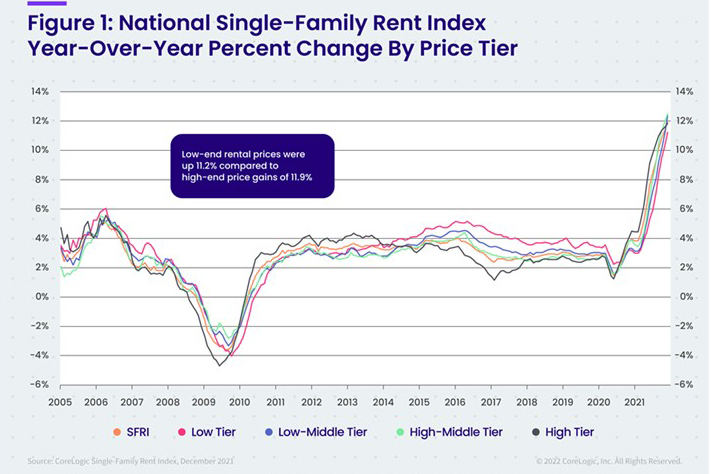

CoreLogic, Irvine, Calif., said single-family rent prices experienced extensive growth during 2021, increasing an average of 7.8% compared to 2.6% in 2020.

The company’s Single-Family Rent Index also reported on a monthly basis, rent prices ended the year with a 12% annual increase in December, up from 3.9% a year ago.

Molly Boesel, principal economist with CoreLogic, said affordability challenges and limited supply created barriers to home purchasing for many prospective buyers. Meanwhile, consumer confidence fell in the latter half of the year, due in part to rising inflation, pushing many to hold on big-ticket purchases like homebuying. She said these factors drove elevated demand for single-family rentals and put increased pressure on the market as vacancy rates also hit historical lows.

The report said national single-family rent growth across the four tiers, and the year-over-year changes, were as follows:

• Lower-priced (75% or less than the regional median): 11.2%, up from 3.2% in December 2020

• Lower-middle priced (75% to 100% of the regional median): 12.4%, up from 3.3% in December 2020

• Higher-middle priced (100% to 125% of the regional median): 12.5%, up from 3.9% in December 2020

• Higher-priced (125% or more than the regional median): 11.9%, up from 4.5% in December 2020

Among the 20 metro areas, Miami had the highest year-over-year increase in single-family rents in December at 35.7%, a significant bounceback from its December 2020 growth rate of 1.4%. Phoenix and Orlando logged the second- and third-highest gains at 18.9% and 17.9%, respectively. These major metros have continued to experience rapid growth year over year and month over month as the tourism industry recovers and job growth continues to improve.Meanwhile, Washington logged the lowest annual rent price growth at 5.3% in December.

The report also noted differences in rent growth by property type emerged after the pandemic as renters sought out standalone properties in lower density areas. This trend drove an acceleration in rent growth for detached rentals in 2021 while growth for attached rentals slowed. However, as rental inventory has remained slim, the gap between attached and detached rental growth started to close in the latter part of the year, with gains of 11.3% and 12.1% respectively in December This is the closest that attached and detached growth rates have been since April 2020.