CoreLogic: Delinquencies Fall Below Pre-Pandemic Levels

Ahead of this Thursday’s National Delinquency Survey from the Mortgage Bankers Association, Corelogic, Irvine, Calif., reported November’s loan delinquency rates fell to levels last seen before the coronavirus pandemic.

The monthly Loan Performance Insights Report for November said 3.6% of all mortgages in the U.S. were in some stage of delinquency (30 days or more past due, including those in foreclosure), a 2.3-percentage point decrease from a year ago, when it was 5.9%.

Other report findings:

–Early-Stage Delinquencies (30 to 59 days past due): 1.2%, down from 1.4% in November 2020.

–Adverse Delinquency (60 to 89 days past due): 0.3%, down from 0.6% in November 2020.

–Serious Delinquency (90 days or more past due, including loans in foreclosure): 2%, down from 3.9% in November 2020 and a high of 4.3% in August 2020.

–Foreclosure Inventory Rate (the share of mortgages in some stage of the foreclosure process): 0.2%, down from 0.3% in November 2020. This remains the lowest foreclosure rate recorded since 1999.

–Transition Rate (the share of mortgages that transitioned from current to 30 days past due): 0.6%, down from 0.8% in November 2020.

CoreLogic Chief Economist Frank Nothaft said the drop below pre-pandemic levels was a sign that mortgage performance is following the nation’s income growth. At the same time, foreclosure rates remain at historic lows as borrowers have been able to lean into the equity generated by a year of record-breaking home price growth. He said these factors combined have helped borrowers weather the lasting economic impacts brought on by the pandemic and avoid falling behind on payments or losing their homes.

“Nonfarm employment rose 6.45 million during 2021, helping to rebuild income for families under financial stress during the pandemic,” Nothaft said. “Income growth has helped to reduce past-due rates and home equity build-up has reduced the likelihood of a distressed sale for families that experience financial challenges.”

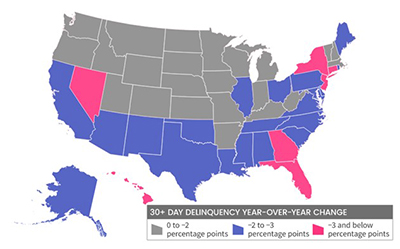

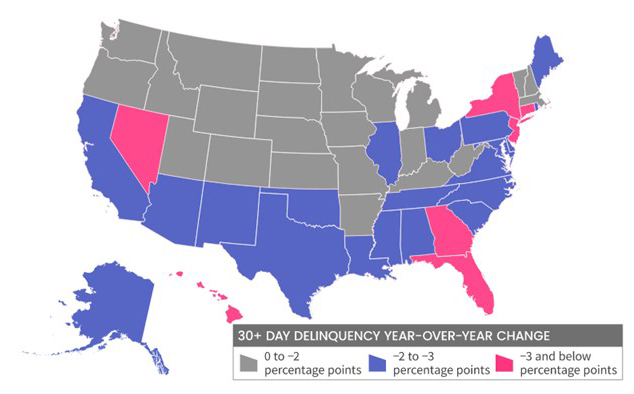

The report said all states logged year over year declines in their overall delinquency rate. States with the largest declines were Nevada (down 3.8 percentage points); New Jersey (down 3.6 percentage points); Hawaii (down 3.5 percentage points); Florida (down 3.4 percentage points); and New York (down 3.2 percentage points).

All except one U.S. metropolitan area posted at least a small annual decrease in their overall delinquency rate. The one area with an annual increase in November was Houma-Thibodaux, La. (up 0.4 percentage points). Houma was impacted by Hurricane Ida in the fall, but its November delinquency rate is an improvement from October as the area works to recover.

On Thursday, Feb. 10, MBA releases its quarterly National Delinquency Report (10:00 a.m.). The NDS, produced by MBA since 1953, covers 39 million loans on one- to four- unit residential properties. Loans surveyed are reported by more than 100 servicers, including independent mortgage companies and depositories such as large banks, community banks and credit unions.

MBA NewsLink will produce a special late morning issue on Thursday with the NDS results, along with commentary and analysis from MBA Vice President of Industry Analysis Marina Walsh, CMB.