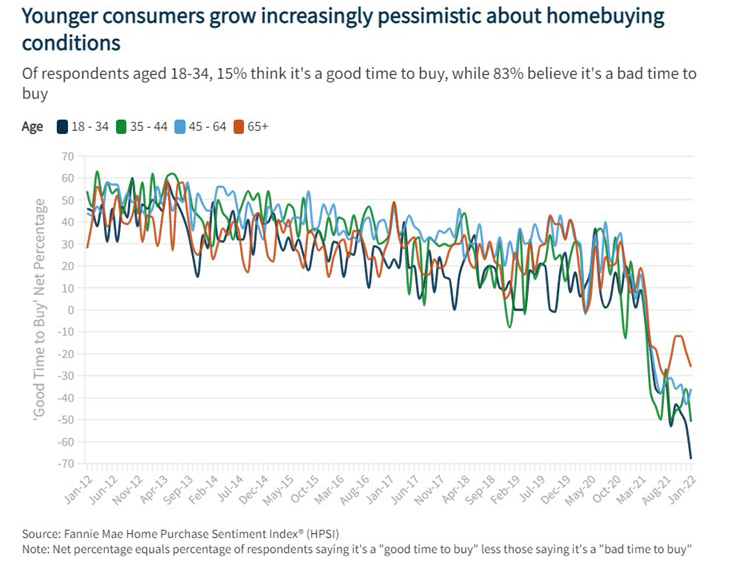

Younger Would-Be Home Buyers Increasingly Pessimistic

The Fannie Mae Home Purchase Sentiment Index fell to its lowest level since just after the start of the pandemic as affordability constraints, particularly involving younger home buyers, continued to weigh on the housing market.

The Index fell by 2.4 points to 71.8 in January, its lowest level since May 2020. The index fell by 5.9 points from a year ago.

Four of the index’s six components decreased month over month, including the components measuring consumers’ perceptions of homebuying and home-selling conditions. A survey record-low 25% of respondents believed it was a good time to buy a home, compared to the 69% of consumers who reported that it’s a good time to sell. Consumers also reported greater concerns about job stability and the future path of mortgage rates. Year over year, the full index is down 5.9 points.

Fannie Mae Chief Economist Doug Duncan said younger consumers – more so than other groups – expect home prices to rise even further, and they also reported a greater sense of macroeconomic pessimism.

“While the younger respondents are typically the most optimistic about their future finances, this month their sense of optimism around their personal financial situation declined,” Duncan said. “All of this points back to the current lack of affordable housing stock, as younger generations appear to be feeling it particularly acutely and, absent an uptick in supply, may have their homeownership aspirations delayed.”

Other survey findings:

–The percentage of respondents who say it is a good time to buy a home decreased from 26% to 25%, while the percentage who say it is a bad time to buy increased from 66% to 70%, for a net decrease of 5 percentage points.

–The percentage of respondents who say it is a good time to sell a home decreased from 76% to 69%, while the percentage who say it’s a bad time to sell increased from 17% to 22%, for a net decrease of 12 percentage points.

–The percentage of respondents who say home prices will go up in the next 12 months decreased from 44% to 43%, while the percentage who say home prices will go down decreased from 19% to 14%. The share who think home prices will stay the same increased from 30% to 35%.

–The percentage of respondents who say mortgage rates will go down in the next 12 months remained unchanged at 4%, while the percentage who expect mortgage rates to go up increased from 56% to 58%. The share who think mortgage rates will stay the same decreased from 30% to 28%.

–The percentage of respondents who say they are not concerned about losing their job in the next 12 months decreased from 82% to 78%, while the percentage who say they are concerned increased from 16% to 17%.

— The percentage of respondents who say their household income is significantly higher than it was 12 months ago remained increased from 23% to 26%, while the percentage who say their household income is significantly lower decreased from 17% to 14%. The percentage who say their household income is about the same decreased from 59% to 56%.