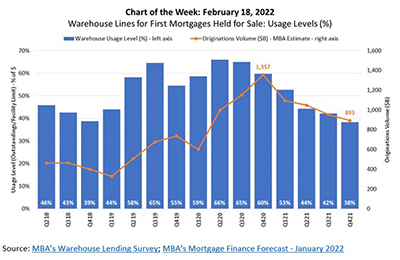

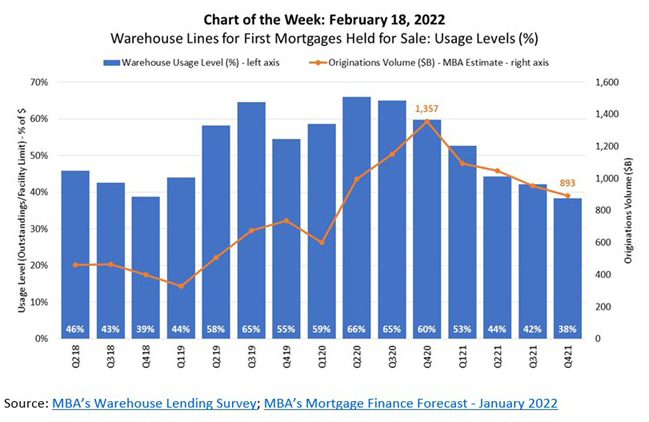

MBA Chart of the Week: Warehouse Lines for First Mortgages

The average usage level of first-mortgage warehouse lines – the percentage of outstanding borrowings to warehouse facility limits – fell for the sixth consecutive quarter to 38% as of the end of the fourth quarter, according to MBA’s quarterly Warehouse Lending Survey. This latest result marks the lowest usage level since inception of the survey in second quarter 2018.

Usage peaked at 66% in second quarter 2020, preceding a record-breaking $1.357 trillion in originations two quarters later. Throughout 2021, usage level declined as originations volume also declined. That said, the decline in usage was not entirely driven by falling volume. During this period, warehouse lenders increased their facility limits in excess of outstanding balances, resulting in decreased usage levels. Outstanding balances on warehouse lines actually increased in four of the past six quarters; however, the warehouse facility limits increased by more.

Usage is calculated as the simple average of each warehouse lender’s quarter-end outstanding balance for first mortgages held for sale, divided by their facility limit for first mortgages. Though facilities for other purposes – second mortgages, MSR financing, GNMA buyouts, construction lending, reverse mortgages, HELOCs, loan repurchases and servicing advances – are tracked as part of the survey, they are excluded from this week’s chart. The usage level recorded for fourth-quarter 2021 is based on a sample of 26 participating warehouse lenders, including community, regiona, and national banks.

If you are a warehouse lender and MBA member that is interested in participating in the first-quarter 2022 survey, please contact us directly.

- Jon Penniman (jpenniman@mba.org); Marina Walsh, CMB (mwalsh@mba.org)