TransUnion: Recent Vintage Loans Perform Well Even as More Non-Prime Consumers Gain Credit

TransUnion, Chicago, said consumer credit performance maintained healthy levels across auto, credit card, personal loans and mortgages in the fourth quarter even as lenders continued to ramp up new account origination growth in the non-prime segment of the market.

The company’s Q4 2021 Quarterly Credit Industry Insights Report also found loans to non-prime borrowers increased while accounts originated during the pandemic in 2020 continued to perform as well or better when compared to loans from previous years.

The credit card market, in particular, saw a very high rate of new account growth in the third quarter with a record 20.1 million originations, 9 million of which were to non-prime consumers. Overall card originations in the quarter grew 63% year-over-year, while non-prime originations increased 75% year over from the 5.1 million non-prime originations that occurred in Q3 2020.

“There was a great deal of uncertainty in the initial months of the pandemic, and many lenders opted to take a wait and see approach,” said Charlie Wise, senior vice president of research and consulting with TransUnion. “Adding to the uncertainty was the jump in consumers in loan accommodation programs, and questions on how those consumers would perform once they exited those programs. Lending to below prime consumers was suppressed and financial institutions turned their focus to the prime areas of the market to help mitigate risk. Toward the end of 2021, the majority of accommodation programs have expired and lenders have seen that consumers continue to perform well on their credit obligations. Lenders are eager to pursue growth, including expanding back into the non-prime consumer segment.”

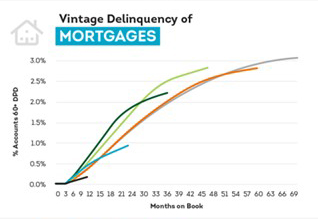

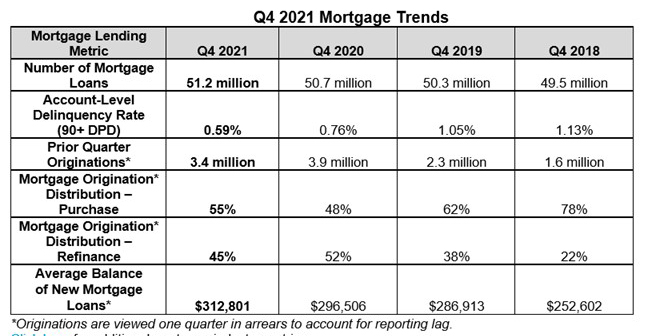

The report said the mortgage industry saw “explosive” growth throughout the pandemic with high levels of originations several quarters in a row due to the low interest rate environment. While non-prime consumers account for a fraction of all originations, the non-prime risk segment has also seen recent growth, with an increase of 17.6% year over year in the third quarter, despite overall originations falling -12.6% in that same period.

The report noted mortgage originations started to slow from the peak levels seen in 2020, dropping -13% year over year to 3.4 million in the third quarter. While this remains far above the pre-pandemic origination levels observed in Q3 2019 (2.3 million), rising interest rates have made it less attractive to secure a rate and term refinance. These refis saw a year over year decrease of -42%.

In contrast cash-out refi grew by 14% year over year, reflecting homeowners’ increase in home equity. Purchase volume remained flat, with the purchase share of originations at 55% in the third quarter. Total mortgage balances reached a record level of $10.7 trillion– up 9% year over year and the highest annual growth rate since before 2010.

“Due to the low interest rate environment earlier in 2021, much of the originations that have occurred in recent quarters came from rate and term refinancing; many mortgage lenders were laser focused on processing that level of volume,” said Joe Mellman Senior Vice President and Mortgage Business Leader with TransUnion. “With the pool of consumers who would benefit from a refinance shrinking and interest rates starting to rise, mortgage lenders will now look to implement diversified growth strategies.”

Mellman said it is becoming more important for lenders to find borrowers that are both in the market for a home and that qualify for one. “New consumer populations, such as the low-to-moderate income consumer segment, have been relatively untapped,” he said. “Consumer demand for a home is still high and with more consumers eyeing home purchases, it can be a lucrative avenue for mortgage lenders to pursue in the year ahead.”