Home Buyers on Budget Stand to Lose Big as Mortgage Rates Rise

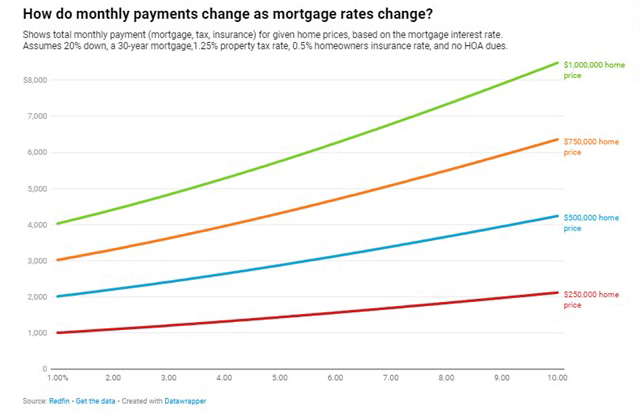

Should mortgage interest rates go higher—and the Mortgage Bankers Association predicts they will hit 4% by the end of the year—home buyers on a fixed budget stand to lose some economic power, said Redfin, Seattle.

Redfin said should rates rise to 3.9% a homebuyer with a $2,000 monthly housing budget could afford a $382,250 home, down from the $396,000 home a buyer with the same budget can afford with a 3.5% rate.

Redfin Chief Economist Daryl Fairweather said the current rise in mortgage rates (MBA reported the 30-year fixed rate has risen by 87 basis points over the past year, to 3.83%) so far hasn’t put a damper on intense homebuyer demand. If anything, it has kept demand strong—pending home sales were up 38% in January from the same period two years earlier.

“If rates were to rise much further in a typical market, we would expect there to be a turning point,” Fairweather said. “Buyers would go from feeling more urgency to buy to feeling less urgency. That’s because rates would ultimately reach a point where renting is more feasible than buying.”

But Fairweather also noted this isn’t a typical market. “Rental prices are soaring too, so instead of renting, many buyers will likely purchase more modest homes in relatively affordable places to avoid increasing their monthly budget,” she said. “That means buyer demand will remain strong for at least the next month and potentially longer, even as rates and prices continue to climb.”

The report said at a 3.9% interest rate, half (50.1%) of homes for sale nationwide in January were affordable for homebuyers on a $2,000 monthly budget, down from 52.2% at a 3.5% interest rate. Popular migration destinations, including Austin, Texas; Atlanta; and Phoenix saw outsized declines.

In Raleigh N.C., for example, 46.3% of homes for sale last month were affordable with that budget at a 3.9% interest rate, down from 50.1% at a 3.5% interest rate. That 3.8-percentage point decline was the biggest drop among the 50 most populous U.S. metropolitan areas. Next came Austin (-3.5 pts), Atlanta (-3.2 pts), Phoenix (-3.1 pts) and Houston (-3.1 pts).

Redfin noted many of these metros have exploded in popularity during the pandemic as homebuyers with big budgets have moved in from expensive coastal cities to work remotely and get more bang for their buck. That has contributed to a surge in housing prices across the Sun Belt.

Meanwhile, at a 3.9% interest rate, 89.4% of homes for sale in Detroit last month were affordable on a $2,000 monthly budget—the highest share among the 50 most populous metros. It was followed by Cleveland (85.4%), Buffalo, NY (83.4%), Pittsburgh (81.3%) and St. Louis (80.4%). Those same five places also had the highest share of homes affordable at a 3.5% interest rate.