January Employment Shows Solid 467,000 Gain

For the first time in months, the Employment Report from the Bureau of Labor Statistics exceeded expectations: employers added 467,000 jobs in January, despite a surge in Omicron-variant coronavirus cases, BLS reported Friday.

Additionally, BLS revised the previous three months’ data to reflect job gains of 1.8 million, compared to the previously reported 1.1 million.

The unemployment rate ticked up slightly at 4.0 percent as more Americans entered the workforce. The number of unemployed persons, at 6.5 million, was little changed. Over the year, the unemployment rate fell by 2.4 percentage points, and the number of unemployed persons declined by 3.7 million. In February 2020, prior to the coronavirus pandemic, the unemployment rate was 3.5 percent, and unemployed persons numbered 5.7 million.

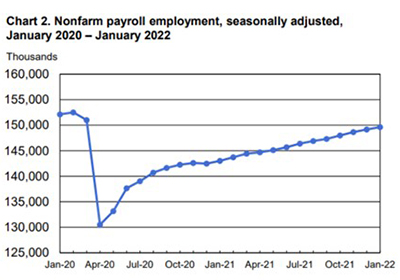

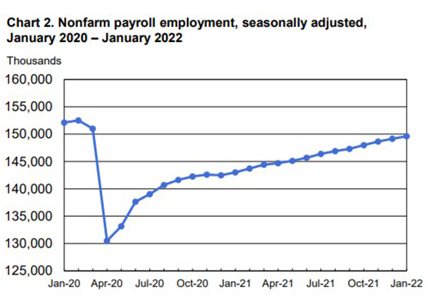

In 2021, nonfarm employment averaged 550,000 per month. Nonfarm employment has increased by 19.1 million since April 2020 but is down by 2.9 million, or 1.9 percent, from its pre-pandemic level in February 2020. The labor force participation rate held at 62.2 percent in January, and the employment-population ratio was little changed at 59.7 percent. Both measures are up over the year but remain below their February 2020 levels (63.4 percent and 61.2 percent, respectively).

The strong report came despite ominous warnings earlier in the week that January’s job numbers could trend negative. In addition to ongoing disruptions stemming from the Omicron variant, on Tuesday, BLS reported in its Job Openings and Labor Turnover Survey (JOLTS) that nearly 11 job openings remained unfilled in December and nearly 5 million more Americans left their jobs. And on Wednesday, ADP reported private-sector employment fell by more than 301,000 in January.

“Faster job growth, more labor force participation, higher wage growth and substantial upward revisions to November and December payroll numbers all point to a job market that is even stronger than we had thought,” said Mike Fratantoni, Chief Economist with the Mortgage Bankers Association. “The job market tightened further in January, despite the impacts of the omicron variant.”

Fratantoni noted some of the strongest employment gains came in sectors such as leisure and hospitality, which continues to recover from pandemic-induced slowdowns. Also notable was the increase in transportation and warehousing jobs, evidence that progress is being made on supply-chain constraints as additional workers enter the sector. Total construction employment dropped, but increased for construction employees involved in residential building.

“The increase in the labor force participation rate is positive in that it shows that employment still has room to run, and that many people who had left the full-time labor force may well venture back in eventually,” Fratantoni said. “While we still expect that the unemployment rate will fall to 3.5% by the end of 2022, there is the potential for it to drop lower if this pace of hiring were to continue.”

“The January employment report topped expectations in nearly every way possible,” said Sarah House, Senior Economist with Wells Fargo Economics, Charlotte, N.C. “Employment growth was broad-based across most industries, and upward revisions to the previous two months suggest that recent momentum in hiring remains very strong. Wage growth also topped expectations, and the earnings data added to the pile of evidence that the labor market is tight.”

House said the labor market is starting the year on a “much better footing” than expected. “[Friday’s] employment report was likely music to the ears of FOMC officials,” she said. Solid employment gains despite the Omicron variant’s emergence give Fed officials more evidence that the U.S. economy is getting better at dealing with the bumps in the road from the pandemic.”

“With revisions, [Friday’s] report does show that labor force participation, which has been slow to recover, is higher than we had previously thought, another positive sign for the labor market recovery,” said Doug Duncan, Chief Economist with Fannie Mae, Washington, D.C. Overall, we believe the robust job growth seen in this month’s report paves the way for the Fed to begin raising rates at their policy meeting next month.”

BLS said average hourly earnings for all employees on private nonfarm payrolls increased by 23 cents in January to $31.63. Over the past 12 months, average hourly earnings have increased by 5.7 percent. Average hourly earnings of private-sector production and nonsupervisory employees rose by 17 cents to $26.92.

Average earnings, Fratantoni said “while still below the pace of inflation, meaning that workers’ purchasing power remains crimped, rising wages will support housing demand this year.”

BLS reported the average workweek for all employees on private nonfarm payrolls fell by 0.2 hour to 34.5 hours in January. In manufacturing, the average workweek edged down by 0.1 hour to 40.2 hours, and overtime edged up by 0.1 hour to 3.3 hours. The average workweek for production and nonsupervisory employees on private nonfarm payrolls decreased by 0.2 hour to 33.9 hours.