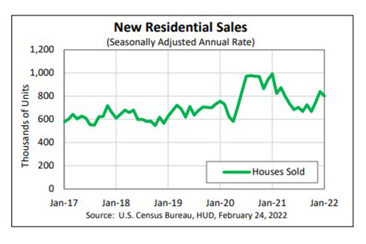

January New Home Sales Down 4.5%

January new home sales fell by 4.5% amid supply chain and inventory shortages, HUD and the Census Bureau reported Thursday.

The report said sales of new single‐family houses in January fell to a seasonally adjusted annual rate of 801,000, 4.5 percent lower than the revised December rate of 839,000 and 19.3 percent lower than a year ago (993,000).

Regionally, only the West saw positive numbers; sales there rose by 1.2 percent to 406,000 units in January, seasonally annually adjusted, from December and improved by 5.3 percent from a year ago.

In the South, sales fell by 7.4 percent in January to 438,000 units, seasonally annually adjusted, from 473,000 units in December and fell by nearly 24 percent from a year ago. In the Midwest, sales fell by 3.7 percent to 78,000 units from 81,000 units in December and fell by 37.1 percent from a year ago. In the Northeast, sales fell by nearly 11 percent in January to 25,000 units from 28,000 units in December and fell by nearly 47 percent from a year ago.

Odeta Kushi, Deputy Chief Economist with First American Financial Corp., Santa Ana, Calif., said the report sends “clear signals” that builders continue to grapple with construction delays due to ongoing supply chain issues and higher material costs.

“Builders face supply-side headwinds that make it difficult and more expensive to build: a lack of construction materials and appliances, chronic construction labor shortages and higher input costs,” Kushi said. “This increases the time needed to build a home and contributes to higher new-home prices.”

Kushi said the report is indicative of some of these challenges. “Builders are entering 2022 with backlogs that they are having a hard time completing due to material and labor shortages,” she said. “And new home prices are sitting near a historic high. Demand for new homes remains strong as there is a lack of existing home inventory, but rising new-home prices may be pricing out some buyers.”

Kushi noted affordability remains a challenge as well, as rising new-home prices may be pricing out some buyers. “One year ago, 29% of new-home sales were priced below $300,000,” she said. “In January of this year, only 9% of new-home sales were priced below $300,000. Rising mortgage rates further worsen affordability.”

Doug Duncan, Chief Economist with Fannie Mae, Washington, D.C., said the report was “modestly weaker than expected,” and may have been held back in part by the Omicron wave and unseasonably cold weather over the month. However, he noted it was still the second highest sales pace since last March.

“Consistent with recent data on existing home sales, we believe many buyers may have rushed to make their purchases around the turn of the year to get ahead of expected increases in mortgage rates,” Duncan said. “We continue to expect new home sales to have a strong year as builders continue working through their current construction backlogs and as demand for new homes remains strong due to the historically tight supply of existing homes available for sale. However, changing monetary and fiscal policy, as well as recent geopolitical events, pose a larger-than-usual risk to both our interest rate and housing activity forecasts. These developments will likely shape our outlooks going forward.”

“The moderation in new home sales over the past year has largely occurred as the result of low inventories and builders throttling back sales amid ongoing shortages of building materials and labor, which have brought on long delays and uncertain completion dates,” said Charlie Dougherty, Economist with Wells Fargo Economics, Charlotte, N.C. “Higher mortgage rates will certainly test the housing market this year. Rising financing costs stand to erode affordability at a time when low inventories continue to pressure home prices. That said, mortgage rates still remain low relative to historical norms. Moreover, there is still a great deal of pent-up demand, as exceptionally low inventories have kept many prospective buyers on the sideline. The recent rally in lumber prices is evidence that supply-side headwinds are likely to persist, however.”

The report said the median sales price of new houses sold in January rose to $423,300; the average sales price rose to $496,900. The seasonally adjusted estimate of new houses for sale at the end of January rose to 406,000, representing a supply of 6.1 months at the current sales rate.