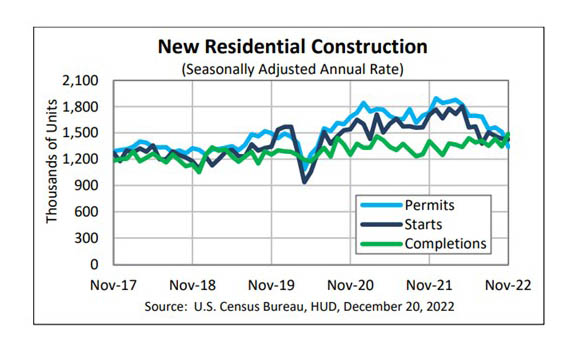

November Housing Starts Down Slightly; Permits Plunge

Housing starts fell in November but beat expectations, the Census Bureau and HUD reported Tuesday. The news, however, came in building permits, which fell sharply from both October and a year ago.

The report said privately owned housing starts in November fell to a seasonally adjusted annual rate of 1,427,000, 0.5 percent below the revised October estimate of 1,434,000 and 16.4 percent (±13.4 percent) below a year ago (1,706,000). Single‐family housing starts in November fell to 828,000, 4.1 percent below the revised October figure of 863,000. The November rate for units in buildings with five units or more rose to 584,000, nearly 5 percent higher than October (557,000) and 24.5 percent higher than a year ago.

Regionally, results were mixed, with the West seeing starts rise by 8.3 percent in November to 341,000 units, seasonally annually adjusted, from 315,000 units in October. From a year ago, starts in the West fell by nearly 21 percent. In the largest region, the South, starts rose by 0.1 percent to 788,000 units in November from 787,000 units in October but fell by nearly 17 percent from a year ago.

In the Midwest, starts fell by 6.5 percent to 215,000 units, seasonally annually adjusted, from 230,000 units in October and fell by 0.5 percent from a year ago. In the Northeast, starts fell by 18.6 percent to 83,000 units in November from 102,000 units in October and fell by 27.2 percent from a year ago.

“Housing starts beat consensus expectations at an annual pace of 1.427 million,” said Odeta Kushi, Deputy Chief Economist with First American Financial Corp., Santa Ana, Calif. “Overall, this month’s report mirrors declining homebuilder confidence, which fell in December for the 12th consecutive month. Housing demand is weakening, while builders continue to face higher costs and supply-side headwinds.”

“Overall, builder sentiment remains gloomy,” said Charlie Dougherty, Economist with Wells Fargo Economics, Charlotte, N.C. “That noted, the improvement in the future sales component is a potential green shoot that indicates builders are starting to see buyer demand stabilize amid lower mortgage rates.”

The report said privately owned housing units authorized by building permits in November fell to a seasonally adjusted annual rate of 1,342,000, 11.2 percent below the revised October rate of 1,512,000 and 22.4 percent lower than a year ago (1,729,000). Single‐family authorizations in November fell to 781,000, 7.1 percent below the revised October figure of 841,000. Authorizations of units in buildings with five units or more fell to 509,000 in November, nearly 18 percent lower than October (620,000) and 10.1 percent lower than a year ago.

“As builders pull back on starting new projects, they will have greater opportunity to bring to market the backlog of homes in their pipelines that are already under construction,” Kushi said. “Permits are a leading indicator of future starts, and this month’s weakness reflects overall weakening housing demand. But the backlog of multi-family homes under construction continues to increase, reaching a record high of 915,000 units in November. More multi-family supply may ultimately put some downward pressure on rents.”

“The broad-based drop indicates that builders and developers are planning to significantly cut-back construction against a backdrop of higher interest rates and elevated economic uncertainty,” Dougherty said.

The report said privately owned housing completions in November rose to a seasonally adjusted annual rate of 1,490,000, 10.8 percent above the revised October estimate of 1,345,000 and 6.0 percent higher than a year ago (1,406,000). Single‐family housing completions in November rose to 1,047,000, 9.5 percent above the revised October rate of 956,000. The November rate for units in buildings with five units or more jumped to 430,000, up by nearly 16 percent from October (371,000) but down by 3.2 percent from a year ago.