Annual Single-Family Rent Price Growth Falls to Single Digits

CoreLogic, Irvine, Calif., said annual U.S. single-family rent growth slowed for the sixth straight month in October to 8.8%, the lowest growth rate in more than a year.

But the CoreLogic Single-Family Rent Index noted the SFR rent growth rate remains three times higher than the pre-pandemic level.

“While rents typically experience a seasonal decline in October, this year’s decrease was larger than average and could point to prices slowing more sharply than expected in the coming months,” said Molly Boesel, Principal Economist with CoreLogic.

Despite the continued cooling, a shortage of available properties is keeping costs elevated, a trend that partially fuels year-over-year gains in lower-priced properties, the report said.

CoreLogic examines four tiers of rental prices. National single-family rent growth across the four tiers, and the year-over-year changes, were:

• Lower-priced (75% or less than the regional median): 11%, up from 9.7% in October 2021

• Lower-middle priced (75% to 100% of the regional median): 9.9%, down from 10.3% in October 2021

• Higher-middle priced (100% to 125% of the regional median): 8.8%, down from 11.4% in October 2021

• Higher-priced (125% or more than the regional median): 7.5%, down from 11.4% in October 2021

Of the 20 largest U.S. metros, Miami posted the highest year-over-year increase in single-family rents in October at 16.3%. Orlando recorded the second-highest gain at 15.5% while Boston ranked third at 12.1%. Honolulu saw the lowest annual rent price gain at 4.8%.

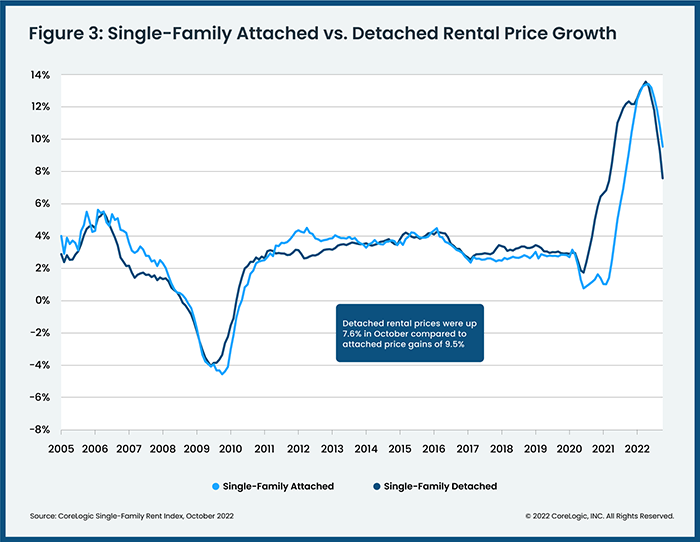

CoreLogic noted differences in rent growth by property type emerged after COVID-19 took hold, as renters sought standalone properties in lower-density areas. “This trend drove an uptick in rent growth for detached rentals in 2021, while the gains for attached rentals were more moderate,” the report said. “As single-family rent prices continued growing rapidly, preferences for attached rentals began to emerge in early 2022, and by summer, they had higher increases than detached properties.”

Attached single-family rental prices grew 9.5% year-over-year in October compared to the 7.6% increase for detached rentals, CoreLogic reported.