Housing Market Roundup: Luxury Home Sales Plummet; Buyers Get Some Leverage Back

Here’s a summary of housing market reports that came across the MBA NewsLink desk over the holidays:

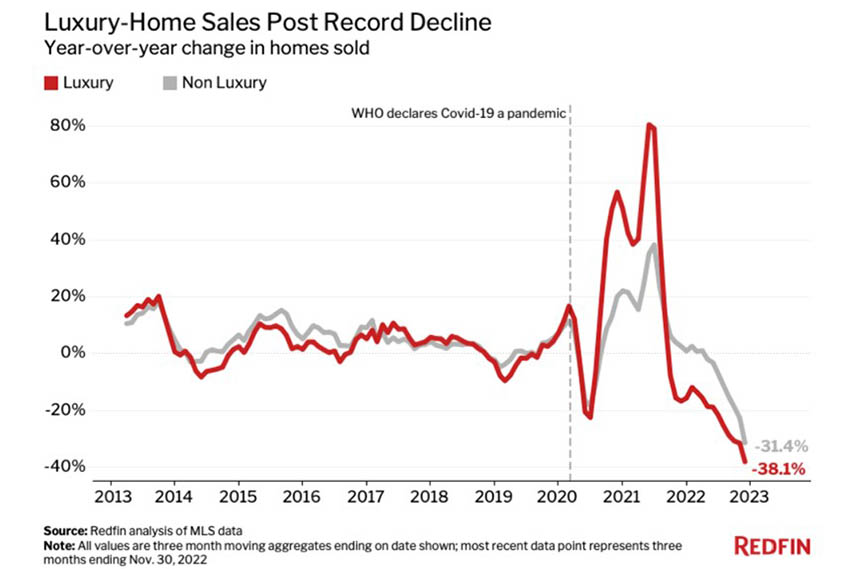

Redfin: Luxury Home Sales Sink 38%, Biggest Decline on Record

Redfin, Seattle, said sales of luxury U.S. homes fell by 38.1% year over year during the three months ending Nov. 30, the biggest decline on record. That outpaced the record 31.4% decline in sales of non-luxury homes.

The report said the luxury market and the overall housing market have lost momentum due to many of the same factors: inflation, relatively high interest rates, a sagging stock market and recession fears. But the high-end market has slowed at a sharper clip for a handful of reasons, including:

–Luxury goods are often among the first to get cut from budgets during times of economic stress.

–Luxury properties are frequently used as investment properties, and with home values and rents poised to fall in 2023, investment prospects are lackluster.

–High-end home sales saw outsized growth during the pandemic, so they have more room to fall.

–Affluent buyers often have significant funds stored in the stock market, which has been losing value.

The report said expensive coastal markets led the decline in high-end home sales. In Nassau County, N.Y. (Long Island), luxury-home sales plummeted 65.6% year over year during the three months ending Nov. 30, the largest decline among the most populous U.S. metropolitan areas. Next came four California metros: San Diego (-60.4%), San Jose (-58.7%), Riverside (-55.6%) and Anaheim (-55.5%).

“These markets are prohibitively expensive for most buyers even when the economy is thriving, so it’s not surprising more buyers would back off during a downturn,” the report said.

The number of luxury U.S. homes for sale rose 5.2% year over year to 163,000 during the three months ending Nov. 30, the largest increase since 2016. By comparison, the supply of non-luxury homes declined 5.7% to about 552,000. The large decline in luxury home sales is contributing to the rise in supply, but new listings are also a factor. New listings of luxury homes fell just 2.9% year over year during the three months ending Nov. 30, compared with a 19.8% drop in listings of non-luxury homes.

However, the report noted early signs that overall homebuyer demand is starting to creep back as interest rates decline, which could ultimately cause the decline in luxury sales to ease. “There has been a small shift in the market that’s not fully showing up in the data yet. With mortgage rates falling, a lot of house hunters see this as their moment to come back and compete,” said Seattle Redfin agent Shoshana Godwin. “Many of my buyers are taking out jumbo loans—mortgages typically used for purchases of high-end homes. While some data shows jumbo mortgage rates above 6%, some of my buyers are getting rates in the low 5% range.”

The report said luxury home sales fell in every metro, while active listings of luxury homes rose in 21 metros. New listings of luxury homes fell in 39 metros.

RE/MAX: Buyers Regain Leverage as More Listings Stay on Market

RE/MAX, Denver, said home sales dipped in November—typical of this time of year—but data also suggest a shift in momentum to home buyers as listings remain longer on the market.

According to the latest RE/MAX National Housing Report, homes sold in November were on the market for an average of 39 days, up four days from October and a full week more than a year ago.

In another positive sign for buyers, there were also more homes for sale than this time a year ago. November’s 2.5 months’ supply of inventory improved from 2.3 in October and more than double the 1.2 of one year ago.

“We’ve been seeing a return to a more balanced market, where not just sellers are in the driver’s seat. Sellers and buyers are each able to negotiate, with neither having a built-in upper hand,” said Nick Bailey, RE/MAX President and CEO. “This is especially good news for long-suffering buyers who are still dealing with affordability issues. Buyers welcome having more choice as there are more homes on the market, and they are taking longer to sell.

The report said November saw a dip in home sales – down 12% from October and down 37% year-over-year. The median of all 53 metro area sales prices fell to $394,000, down 1.3% from October, but up 3.7% from a year ago.