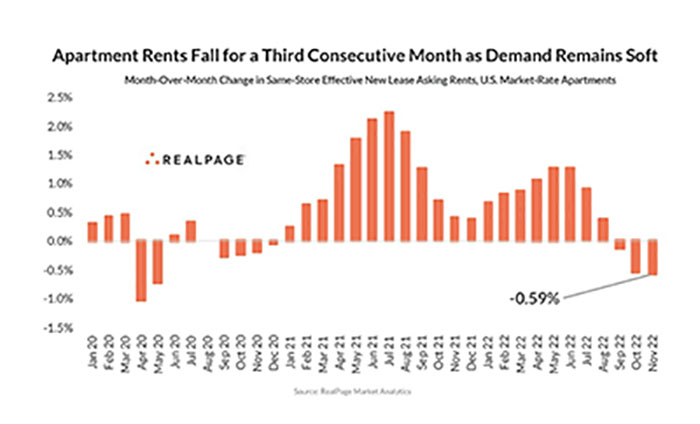

Apartment Rents Fall for 3rd Straight Month; Leasing Traffic Remains Soft

RealPage, Richardson, Texas, reported apartment rents declined in November for the third consecutive month.

“Although fall/winter cuts were very normal seasonally prior to COVID, this isn’t just normal seasonality,” said Jay Parsons, Head of Economics & Industry Principals with RealPage. “Cumulative cuts over the last three months are the largest for any three-month period since 2010, with the exception of the 2020 lockdown period.”

RealPage reported same-store effective asking rents for new leases nationally fell 0.59% in November. “That marked the third-largest month-over-month cut since 2010, topped only by April and May 2020 at the height of pandemic lockdowns, and a hair deeper than October 2022’s reduction,” Parsons said.

The effective rent cuts come as apartment occupancy has fallen a bit below pre-pandemic highs due to weak new-lease demand, the report said. Occupancy remains high at 95.1%, but is down 240 basis points year-over-year.

“Interestingly, the issue is not renter turnover,” Parsons noted. “In fact, turnover in November 2022 was the second-lowest for any November on record; topped only by November 2021. But the issue is at the front door. Leasing traffic among prospective renters has plummeted throughout 2022, and November 2022 ranked as the weakest for any November in eight years.”

Parsons found little evidence renters are doubling up to any significant degree due to affordability concerns.

“There is very little net new demand for any type of housing right now, despite strong growth in jobs and wages,” Parsons said. “We’ve never before seen new-lease apartment demand freeze up during a period of solid job gains like it has this year. We’re on track to end 2022 with the weakest net apartment demand since 2009. Low consumer confidence and weak household formation tells us Americans are in wait-and-see mode.”

Parsons said most parts of the country could see further rent cuts over the next few months. “Rent cuts are seasonally common in December, followed by flat to very slight growth in January and February, but the current trajectory of weak new-lease demand suggests deeper-than-normal rent cuts throughout the winter,” he said. “The big question is whether leasing traffic returns in March and April when the leasing season typically starts. That should, in theory, occur given the still-hot labor market–assuming the job market holds up and inflation cools off. Remember we’ve never before seen a period like 2022 where job growth and wage growth are robust, but demand for all types of housing is weak. But we’ll see.”