CoreLogic: Home Equity Gains Down Sharply From Second Quarter

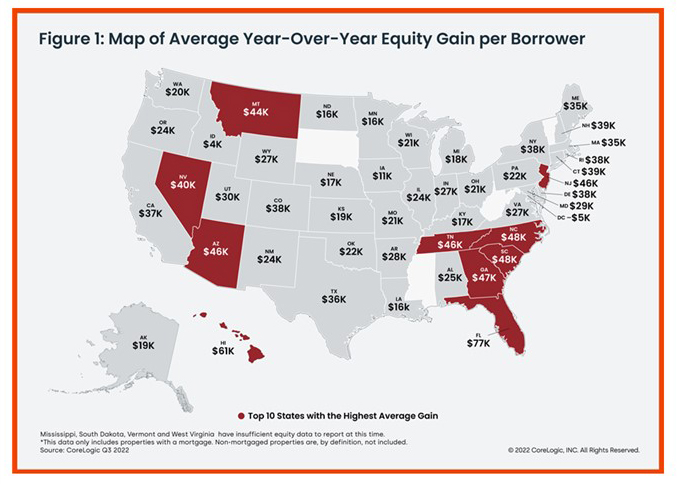

CoreLogic, Irvine, Calif., reported homeowners posted average annual equity gains of $34,300 in the third quarter—half the year-over-year increase recorded in the second quarter.

The company’s quarterly Homeowner Equity Report said homeowners with mortgages (63% of all U.S. properties) saw equity increase by 15.8% year over year, representing a collective gain of $2.2 trillion, for an average of $34,300 per borrower, from a year ago.

However, the report noted annual home equity gains began to slow in the third quarter, compared to the nearly $60,000 year-over-year gain recorded in the second quarter. Slowing prices also caused an additional 43,000 properties to fall underwater.

CoreLogic said the quarter-over-quarter decline in equity is partially due to cooling home price growth across the country, as annual appreciation fell from 18% in June to just slightly more than 10% in October. As home price gains are projected to relax into single digits for the rest of 2022, then possibly move into negative territory by the spring of 2023, equity increases will likely decline accordingly in some parts of the country.

“At 43.6%, the average U.S. loan-to-value ratio is only slightly higher than in the past two quarters and still significantly lower than the 71.3% LTV seen moving into the Great Recession in the first quarter of 2010,” said Selma Hepp, interim lead of the Office of the Chief Economist at CoreLogic. “Therefore, today’s homeowners are in a much better position to weather the current housing slowdown and a potential recession than they were 12 years ago.”

The report said an additional 43,000 properties fell underwater. “Weakening housing demand and the resulting decline in home prices since the spring’s peak reduced annual home equity gains and pushed an additional number of properties underwater in the third quarter,” Hepp said. “Nevertheless, while these negative impacts are concentrated in Western states such as California, homeowners with a mortgage there still average more than $580,000 in home equity.”

The report said from the second quarter to the third quarter, mortgaged homes in negative equity increased by 4% to 1.1 million homes, or 1.9% of all mortgaged properties. On an annual basis, 1.2 million homes, or 2.2% of all mortgaged properties, were in negative equity. This number declined by 9.8% in the third quarter, to 1.1 million homes or 1.9% of all mortgage properties.