Fannie Mae, Freddie Mac Announce Replacement Rates for Legacy LIBOR Products

Fannie Mae and Freddie Mac announced replacement rates for legacy LIBOR loans and securities.

The replacement indices are the benchmark replacements recommended by the Federal Reserve Board and are based on the Secured Overnight Financing Rate (SOFR). The transition to these replacement indices will occur the day after June 30, 2023, the last date on which the Intercontinental Exchange Inc. (ICE) Benchmark Administration Limited will publish a representative rate for all remaining tenors of LIBOR.

This announcement follows the Federal Reserve Board’s publication of the final rule pursuant to the Adjustable Interest Rate (LIBOR) Act of 2021. Under that Act, the Federal Reserve Board is the regulator required to select the benchmark replacement for legacy USD LIBOR contracts that are governed by U.S. law.

“The announcement of replacement rates for their LIBOR-indexed products today by Fannie Mae and Freddie Mac represents one of the closing milestones in the transition to more robust reference rates to replace LIBOR,” said Federal Housing Finance Agency Director Sandra Thompson. “FHFA and its regulated entities have worked closely with the Alternative Reference Rates Committee and the Official Sector to ensure a transparent and smooth transition.”

“Our announcement today represents a key milestone necessary to prepare the mortgage market for the cessation of LIBOR,” said Bob Ives, Fannie Mae Chief Investment Officer. “It has always been our goal to support an orderly and successful transition from LIBOR in coordination with the Federal Housing Finance Agency, the Alternative Reference Rates Committee, and other mortgage market participants and we will continue to work toward that goal.”

“Freddie Mac’s transition of existing LIBOR contracts to a new index rate will mark the conclusion of a long and consequential project to replace the index in those contracts,” said John Glessner, Freddie Mac senior vice president and head of the Investments and Capital Markets.

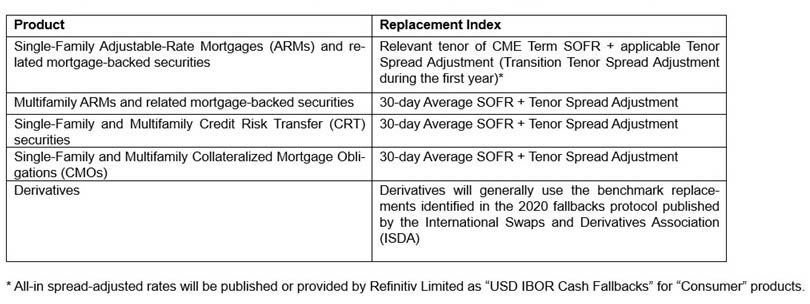

Fannie Mae said the following table lists the replacement index, as specified in the final rule, for each legacy LIBOR product specified below:

The transition will include Freddie Mac’s legacy LIBOR-indexed single-family adjustable-rate mortgages (ARMs), derivatives, multifamily floating rate loans, multifamily floating rate mortgage-backed securities, collateralized mortgage obligations and credit risk transfer securities. Freddie Mac plans to transition as follows:

• For Single-Family ARMs, Freddie Mac servicers will be instructed to transition to the all-in spread-adjusted term SOFR reference rates recommended by the Federal Reserve Board and administered and published by Refinitiv Limited, which include a one-year transition period.

• Derivatives will generally use the benchmark replacements identified in the 2020 fallbacks protocol published by the International Swaps and Derivatives Association.

• Multifamily floating rate loans, multifamily floating rate mortgage-backed securities, collateralized mortgage obligations and credit risk transfer securities will transition to the all-in replacement rates recommended by the Federal Reserve Board for FHFA-regulated-entity Contracts. These rates are composed of the 30-day average SOFR rate published by the Federal Reserve Bank of New York, plus an applicable tenor spread adjustment.